When you get right down to it, the Walmart Marketplace vs Amazon debate is really about scale versus opportunity. Amazon gives you incredible reach and sales velocity, but you’re fighting for every inch in a crowded, mature ecosystem. Walmart, on the other hand, offers a strategic path for growth with far less competition and, for the right brands, potentially better margins.

Your Executive Guide to Choosing a Marketplace

As an ecommerce leader, deciding where to put your brand’s resources is a high-stakes game. The right platform can kickstart serious growth, but the wrong one can bleed your budget dry with little to show for it. This guide gives you a direct, no-fluff overview to help you make that initial call.

There's no denying Amazon is the giant in the room. It’s a high-volume, fast-moving environment where brands with established reputations and deep advertising pockets can pull in massive sales. If you’re ready to compete aggressively on price, service, and visibility, this is your arena. Its enormous traffic and world-class fulfillment network make it a primary channel for a reason.

Walmart Marketplace, in contrast, is a powerful diversification play. It’s a chance to get in front of a huge, loyal U.S. customer base in a less saturated space. For brands getting squeezed by Amazon’s cutthroat competition and climbing ad costs, Walmart is a compelling alternative to carve out a strong foothold and grab market share.

Key Takeaway: Think of Amazon as a bustling metropolis—millions of customers are there, but you have to shout to be heard. Walmart is the fast-growing suburb; it's still massive, but there's more room to build your presence and actually stand out.

While choosing between giants like Walmart and Amazon is a critical step, smart brands are also exploring options beyond marketplaces to build a truly resilient ecommerce strategy.

To make your initial evaluation easier, I've put together a table that breaks down the fundamental trade-offs. Use it to quickly see the key differences and figure out which platform aligns better with where your brand is now—and where you want it to go. Think of this as the first step in deciding which marketplace to prioritize.

Quick Comparison Walmart Marketplace vs Amazon

| Attribute | Amazon | Walmart Marketplace |

|---|---|---|

| Primary Audience | Global, diverse, often Prime-focused | U.S.-centric, value-conscious shoppers |

| Competition Level | Extremely High (~1.9M active sellers) | Moderate but Growing (~150,000 sellers) |

| Seller Fees | Monthly subscription + referral fees | Referral fees only (no monthly subscription) |

| Fulfillment | Fulfillment by Amazon (FBA) | Walmart Fulfillment Services (WFS) |

Analyzing Audience Reach and Market Share

When you're weighing Walmart Marketplace against Amazon, the first thing to look at is the sheer number of eyeballs each platform commands. The size and type of customer base you can tap into will shape everything—your sales potential, your ad strategy, and how visible your brand becomes. Think of Amazon and Walmart as two completely different ponds to fish in.

Amazon’s dominance as the global e-commerce king is built on one thing: massive, relentless traffic. It pulls in a diverse, worldwide audience that’s been trained to expect convenience, lightning-fast delivery, and an endless aisle of products. This is why it’s the default starting point for brands shooting for maximum exposure and high-volume sales. The numbers don't lie.

Amazon: The Undisputed Traffic King

Amazon's power isn't just a perception; it's backed by some truly staggering data. Drawing billions of visits every month, the platform is a vast ocean of potential customers.

But that scale comes with a huge trade-off: savage competition. With millions of other sellers fighting for attention, just showing up isn't enough. You need a sophisticated, well-funded strategy to carve out your space. Brands have to be ready to invest heavily in advertising just to get seen.

The Amazon Equation: Unmatched traffic plus extreme seller saturation. This means high sales potential, but it also means high costs to acquire a customer. You need a great product and a mastery of the platform to win.

In 2025, Amazon still dwarfs Walmart in online traffic, pulling in an incredible 2.82 billion visits in July alone—that's about six times more than Walmart. This is why Amazon snagged nearly 10% of total U.S. retail spending in Q2 2025. While Amazon’s full-year 2024 revenue hit $638 billion, Walmart’s fiscal 2025 revenue reached $681 billion, proving Walmart’s overall retail muscle but its lag in the purely online arena. You can dig deeper into these numbers in our comprehensive guide to Amazon sales data.

Walmart: A U.S.-Centric Powerhouse

While Amazon casts a global net, Walmart’s strength is its deep roots in the American market. Its customer base is famously loyal, value-focused, and increasingly comfortable blending online shopping with in-store pickups.

Walmart’s online presence is growing at a clip, thanks to smart investments in its marketplace and fulfillment services. It now hosts over 160,000 third-party sellers—a 40% jump year-over-year—making it an increasingly attractive option. That kind of growth is a clear signal that it's becoming a serious player.

And the less crowded field offers some real strategic advantages.

- Better Organic Visibility: With fewer sellers to elbow out, new brands have a much better shot at ranking in search results without a massive ad budget.

- Lower Advertising Costs: Less competition on Walmart Connect often means a lower cost-per-click (CPC). Your ad dollars just go further.

- A Targeted Demographic: If you sell value-driven products, household goods, or anything that resonates with American families, you'll find a highly receptive audience here.

For brands that feel lost in the noise on Amazon, Walmart’s marketplace is fertile ground for growth. It offers a more accessible path to building a real market presence. The choice really comes down to whether your brand is better equipped to swim in Amazon’s vast, competitive ocean or to cultivate success in Walmart’s rapidly expanding, U.S.-focused territory.

Comparing Fulfillment: Walmart WFS vs. Amazon FBA

Choosing your fulfillment partner is one of the biggest decisions you'll make. It’s not just about shipping; it’s about your costs, customer experience, and ultimately, your profitability. Both Fulfillment by Amazon (FBA) and Walmart Fulfillment Services (WFS) promise to take care of storage, picking, packing, and shipping, but they come at it from completely different angles.

Amazon FBA is the undisputed heavyweight. It's a massive, global logistics machine that powers the Prime two-day shipping promise millions of customers take for granted. For most sellers, using FBA isn't optional—it's the price of admission. Getting that Prime badge is critical for visibility and conversions. If you're new to the concept, our guide explains in detail what is Amazon FBA and how it works.

But all that power comes with baggage. FBA’s fee structure is notoriously complex. You’re hit with fulfillment fees, monthly storage fees, and long-term storage penalties that can bleed your margins dry if you're not careful. Amazon also enforces rigid inventory performance metrics, punishing sellers for slow-moving stock, which means you have to manage your inventory with near-perfect precision.

WFS: The Cost-Effective Contender

Walmart Fulfillment Services (WFS) has emerged as a leaner, and often cheaper, alternative. Designed to go head-to-head with FBA, WFS gives sellers access to Walmart’s powerful supply chain, offering fast two-day shipping across the nation. Products fulfilled through WFS get a "Fulfilled by Walmart" tag, which builds trust and boosts visibility on the platform.

The biggest draw for WFS is its straightforward and more affordable fee structure. With no monthly subscription fees for the marketplace and competitive fulfillment rates, it’s a breath of fresh air for brands that are tired of Amazon's nickel-and-diming. While WFS has its own rigorous standards, they are generally seen as less punitive than Amazon's, giving sellers more breathing room with inventory management.

Key Differentiator: FBA offers unmatched scale and the powerful Prime badge, but it comes at a higher cost and demands strict inventory discipline. WFS delivers a high-performance, cost-effective fulfillment solution for the U.S. market with a much simpler fee structure.

The cost savings can be significant. Some studies show WFS fees can be 15-25% lower than FBA for similar products, while still delivering a 40-60% sales lift for items that qualify. This is a huge reason why so many sellers are finally diversifying away from an Amazon-only strategy.

WFS vs FBA: A Strategic Feature Breakdown

To really understand the trade-offs, you need to look beyond just the price tag. The decision comes down to your operational needs, from network reach and inventory rules to seller support.

Here’s a side-by-side comparison of the features that will actually impact your business.

| Feature | Walmart Fulfillment Services (WFS) | Fulfillment by Amazon (FBA) |

|---|---|---|

| Shipping Promise | Nationwide two-day shipping. | Prime two-day shipping, plus next-day and same-day options in many areas. |

| Network Scope | U.S.-focused fulfillment centers. | Extensive global network of fulfillment centers. |

| Fee Structure | Simple, fixed fees based on weight and dimensions. No long-term storage fees. | Complex fees including storage, fulfillment, and penalties like overage fees. |

| Inventory Rules | More lenient inventory requirements. | Strict inventory performance index (IPI) scores and storage limits. |

| Multi-Channel | Primarily for Walmart.com orders. | Offers Multi-Channel Fulfillment (MCF) for other sites (with some restrictions). |

So, which one is right for you?

If your goal is maximum global reach and you have the operational muscle to navigate complex fees and tight inventory controls, FBA is still the dominant player. But if you’re a U.S.-focused brand looking for a profitable growth channel with less operational headache, WFS is a powerful and financially sound alternative.

For many sellers, the smartest move isn't choosing one over the other. It’s using both. Leveraging WFS is a fantastic way to diversify, reduce your dependence on Amazon, and protect your business from the high costs and risks of putting all your eggs in one basket.

Understanding Seller Fees and True Profitability

When you're comparing Walmart Marketplace and Amazon, your real profitability comes down to understanding the full cost of selling on each platform. It's easy to get fixated on the headline referral fees, but your true net margin is eaten away by a complex web of costs that go way beyond a single percentage.

To get an accurate forecast of what you'll actually take home, you have to look at every single charge. This means accounting for monthly subscriptions, fulfillment and storage costs, ad spend, and other random fees that can quietly bleed you dry. A small difference in one fee can create a huge gap in your bottom line, so a full cost breakdown is non-negotiable.

The Foundation: Subscription and Referral Fees

The first and most obvious difference between Walmart and Amazon is the cost of entry. Right off the bat, Walmart has a clear edge for new or smaller sellers by charging no monthly subscription fee. You only pay when you sell something, which lowers the barrier to entry and lets you get started without an upfront investment.

Amazon, on the other hand, runs on a different model. If you’re serious about selling, you’ll need their Professional Seller plan, which comes with a $39.99 monthly subscription fee. This fixed cost means you start every month in the hole, needing a certain number of sales just to break even on the fee itself.

Both platforms charge a referral fee on each sale—a percentage of the total price that usually ranges from 8% to 15%, depending on the category. The rates are pretty comparable, but that lack of a monthly fee on Walmart makes it a much safer bet for businesses testing the waters or working with tight margins.

The Real Impact: For a brand selling 100 units a month, Amazon's subscription fee adds a fixed cost of roughly $0.40 per unit. While that sounds small, this cost is completely nonexistent on Walmart, improving your per-unit profitability from the very first sale.

Decoding the Full Cost of Fulfillment

Beyond the basic fees, fulfillment and storage charges are the biggest and most unpredictable expenses you'll face. Both WFS and FBA have complex pricing based on product size, weight, and how long it sits on a shelf, but the tiny details are what make all the difference.

When you're digging into the costs of selling on Amazon, mastering specific Amazon pricing strategies is essential to understanding what you'll actually pocket.

Let's break down how these costs can really diverge with a quick example.

Example Scenario: Selling a 1.5 lb Kitchen Gadget

- Amazon FBA: You’re looking at a fulfillment fee of around $5.00, plus monthly storage fees. During Q4, those storage fees can jump significantly. And if your product sits too long, you’ll get hit with painful long-term storage penalties.

- Walmart WFS: For that same item, the fulfillment fee could be closer to $4.25. Walmart’s storage fees are often more competitive, and since it doesn't currently impose the same harsh long-term storage penalties as Amazon, you have more flexibility.

That $0.75 difference in fulfillment adds up fast. If you're selling 1,000 units a month, that's an extra $750 in your pocket just by using WFS. This is a perfect example of why so many brands are adopting a multi-channel strategy—the savings on one platform can be massive. If you want to get deeper into pricing, check out our guide on how to determine the price of a product for any marketplace.

The Hidden Costs: Advertising and Returns

Finally, you can't forget about advertising and returns. On Amazon, the intense competition in most categories means a hefty advertising budget isn't optional; it's required to stay visible. Cost-per-click (CPC) rates can get painfully high, making it a major ongoing expense.

Because Walmart Connect is a less saturated ad platform, you can often find a lower CPC. This lets you acquire customers more affordably, stretching your marketing budget further and directly boosting your net profit.

Returns are another area where costs can sneak up on you. While both platforms handle returns, the associated fees aren't the same. Amazon's return fees, especially for categories like apparel, can be complex and expensive. You have to model these potential costs carefully, because a high return rate can quickly turn a profitable product into a money pit.

Advertising Competition and Product Discoverability

Getting your products noticed is everything in ecommerce. When you’re looking at Walmart Marketplace vs Amazon, the roads to getting discovered couldn't be more different. One is a mature, hyper-competitive arena, while the other is an emerging frontier with a lot less noise.

Amazon: The Pay-to-Play Behemoth

Amazon's marketplace is a massive global bazaar with roughly 1.9 million active sellers. With that many people shouting for attention, organic visibility is almost a fantasy. Simply listing a great product is like whispering in a stadium—if you want to be heard, you have to pay to play through Amazon Advertising.

The platform’s ad tools are powerful, no doubt. You’ve got Sponsored Products, Sponsored Brands, and Sponsored Display ads. But maturity comes with a price: fierce competition. Cost-per-click (CPC) rates in popular categories can be brutal, demanding sophisticated bidding strategies and a serious ad budget just to land on the first page.

Amazon's Discoverability Challenge: Success isn’t about being found organically anymore. It's about outbidding and out-strategizing millions of other sellers. A hefty ad budget isn't a bonus; it’s the cost of entry.

Walmart Connect: The Emerging Opportunity

In sharp contrast, Walmart Marketplace is a much more curated space with only about 150,000 sellers. That number alone completely changes the game. With far fewer competitors, your products actually have a fighting chance to show up in organic search results, opening a path to visibility that slammed shut on Amazon years ago.

This is where Walmart Connect, its advertising platform, gives sellers a real strategic edge. It offers similar ad types, like Sponsored Search and Sponsored Brands, but the competition is nowhere near as intense.

For sellers, this translates into some major wins:

- Lower Cost-Per-Click (CPC): Fewer advertisers bidding on the same keywords means CPCs are generally much lower than on Amazon. Your ad budget goes a lot further here.

- Higher Return on Ad Spend (ROAS): When you combine lower ad costs with solid conversion rates, you’re looking at a much healthier ROAS, which directly boosts your profitability.

- Unique Ad Formats: Walmart Connect also leverages its massive physical store footprint, offering unique ad formats and opportunities that Amazon simply can’t match.

For brands getting squeezed by Amazon’s rising ad costs, Walmart is a breath of fresh air. It offers a more level playing field where a smart, targeted ad strategy can drive real growth without needing a massive budget. The principles are similar, so if you want to get the mechanics down, you can learn more about PPC on Amazon and apply that knowledge to Walmart.

How to Allocate Your Ad Spend

Where you put your ad dollars should come down to your brand’s goals and resources. If you're launching a new product, getting early traction on Walmart can be faster and cheaper. You can build sales velocity and gather reviews without getting drowned out.

For an established brand, the math is different. Amazon is still the king for sheer volume, which often justifies the higher ad costs for your core products. But ignoring Walmart means you’re leaving money on the table in a market that's growing fast.

A balanced approach is usually best. Use Amazon for your high-volume hero products where you can afford to be aggressive. At the same time, use Walmart’s lower-cost environment to test new items, reach value-focused shoppers, and build a profitable second sales channel. This diversifies your revenue and makes you less dependent on a single, crowded marketplace.

How to Choose the Right Marketplace for Your Brand

The Walmart Marketplace vs. Amazon debate doesn’t have a simple winner. The right platform for your brand comes down to your business model, how much capital you have, and what you’re trying to achieve long-term. Making the right call means taking a hard, honest look at your strengths and how much risk you’re willing to take.

Instead of a one-size-fits-all answer, think of this as a framework. I've broken down the key differences in audience, fees, and competition into a practical guide to help you decide.

When to Prioritize Amazon

Go with Amazon if your brand is well-capitalized and you're ready to jump into a hyper-competitive arena. It's the ideal primary channel if you have a unique product with strong market potential and you’re prepared to invest heavily in a sophisticated advertising strategy from day one.

Amazon is built for brands that can handle:

- High Ad Spend: Success here demands a serious budget for Sponsored Products and Brands just to get noticed among millions of other sellers.

- Complex Fee Structures: You need the margins to absorb higher fulfillment costs and a monthly subscription fee while still turning a profit.

- Aggressive Competition: Be ready to compete fiercely on price, reviews, and service to win the Buy Box. It’s a constant battle.

Simply put, Amazon is a high-risk, high-reward environment. The potential for massive sales volume is unmatched, but getting there requires significant resources and operational excellence right out of the gate.

Key Insight: Prioritize Amazon when your main goal is maximum reach and you have the cash to fund an aggressive customer acquisition strategy. It’s an environment where the biggest and boldest brands can achieve immense scale.

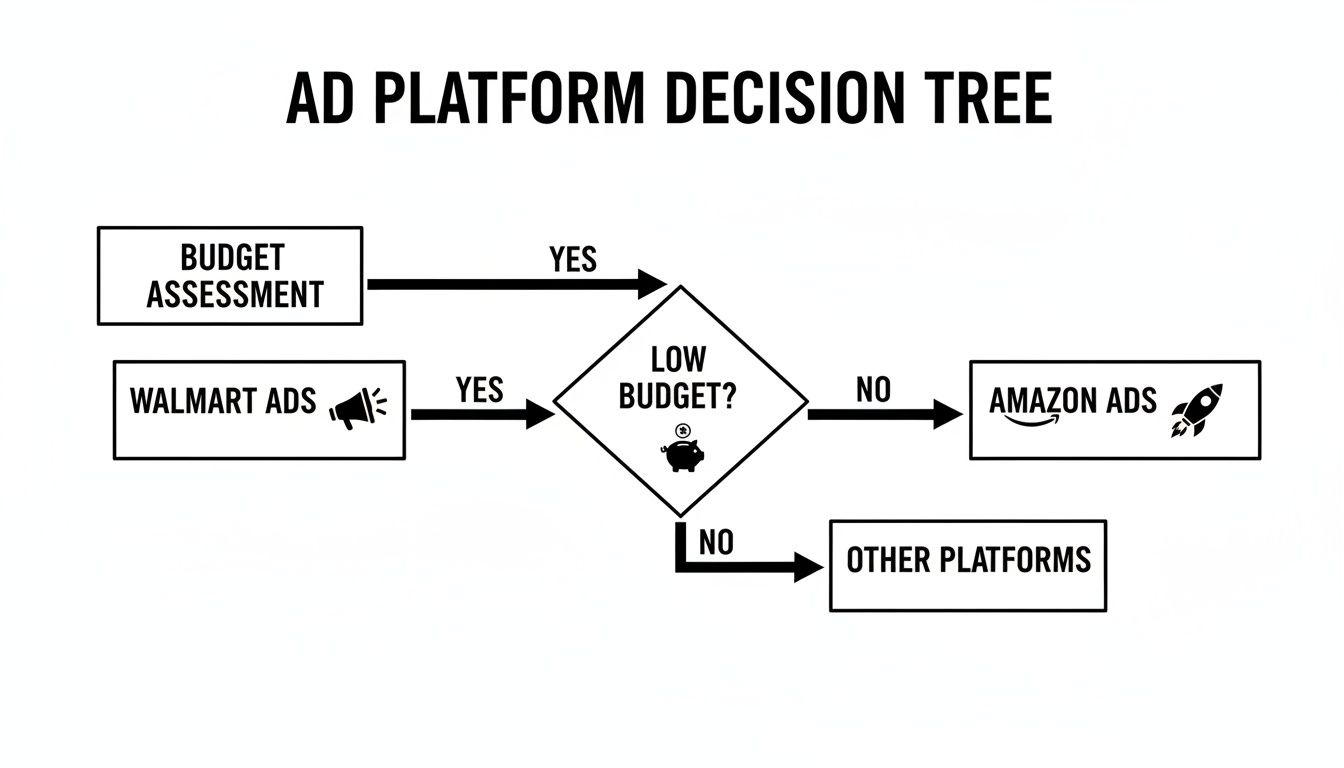

This decision tree gives you a visual for how budget alone can steer your choice.

As the graphic shows, brands with smaller budgets might find Walmart a more manageable starting point, while those with deeper pockets can compete more effectively on Amazon.

When to Prioritize Walmart Marketplace

Choose Walmart Marketplace if you’re a cost-conscious brand looking for a profitable secondary channel or a primary market that isn’t so saturated. It's a strategic move for businesses aiming to build a solid foundation without the sky-high entry costs of Amazon.

Walmart is the better fit if you want:

- Lower Competition: With way fewer sellers, your products have a much better shot at gaining organic visibility and traction.

- More Favorable Margins: No monthly subscription fee and generally lower fulfillment and ad costs mean you keep more profit from every sale.

- A U.S.-Focused Audience: This platform is perfect for brands whose target customer is the value-driven American household.

If you’re looking for a detailed walkthrough, our guide on how to sell on Walmart Marketplace lays out the entire process step-by-step. Walmart gives you a more controlled environment to grow your brand, build a loyal customer base, and establish a profitable e-commerce operation.

Ultimately, the smartest brands often don't choose one over the other. A multi-channel strategy—using Amazon for volume and Walmart for profitable growth—is usually the most resilient approach. This diversifies your revenue and makes your business less dependent on a single platform, which is just smart planning for the future.

Frequently Asked Questions

When you're weighing Walmart Marketplace vs. Amazon, the practical questions always come up. How hard is it to get started? What do the day-to-day operations look like? Here are some straight answers to the most common questions sellers have.

Is It Difficult to Get Approved on Walmart Marketplace?

Yes, getting approved to sell on Walmart Marketplace is a much tougher process than getting started on Amazon. Walmart keeps its marketplace more curated, and their vetting process is no joke. They’re looking for established businesses with a solid track record in ecommerce and a history of great customer service.

To even apply, you’ll generally need:

- A U.S. Business Tax ID (your SSN won’t cut it).

- A W-9 or W-8 form and an EIN Verification Letter.

- A proven history of successful ecommerce or marketplace operations.

This selective approach means you'll face less competition once you’re in, but it’s a major hurdle for new sellers just breaking into the market.

Can I Use the Same Inventory for FBA and WFS?

No, you can't use a single pool of inventory for both Amazon FBA and Walmart WFS. Each program demands its own dedicated shipments sent to their respective fulfillment centers. This split forces you into careful inventory management to avoid stocking out on one platform while being overstocked on the other.

A lot of sellers solve this headache by bringing in a third-party logistics (3PL) provider. A 3PL can manage your central inventory and then strategically send stock to FBA and WFS centers as needed, which really simplifies your supply chain.

Which Platform Offers Better Brand Protection Tools?

Right now, Amazon has the clear edge with its mature and comprehensive Amazon Brand Registry program. It comes packed with powerful features like Project Zero, which helps proactively shut down counterfeit listings, and the Transparency program for serializing individual products.

Walmart is catching up with its Walmart Brand Portal, giving rights owners tools to manage their intellectual property. However, Amazon’s toolkit is simply more established and robust. If counterfeits and IP theft are major concerns for your brand, Amazon’s ecosystem offers a much stronger defense. The choice between Walmart Marketplace vs. Amazon can often come down to how much you value these protections.

Ready to stop guessing and start growing on the right marketplace? The experts at Next Point Digital create data-driven strategies for Amazon and Walmart that convert clicks into loyal customers. Let's build your custom growth plan.