Nailing down the right price for your product is a tricky balancing act. You have to cover your costs, see what the competition is doing, and, most importantly, understand what customers think your product is worth. A truly effective pricing strategy pulls from all three of these areas to land on a number that’s profitable, competitive, and actually appealing to your target market.

Your Starting Point for Smart Product Pricing

Figuring out what to charge can feel like a shot in the dark, but it doesn't have to be. A solid pricing framework is the bedrock of profitability and market positioning. To get there, you first need to get familiar with the three core models that virtually every successful business relies on.

These foundational approaches give you different lenses through which to view your pricing, each with its own pros and cons.

-

Cost-Plus Pricing: This is the most straightforward method out there. You simply calculate your total product costs—materials, labor, overhead, you name it—and add a set markup. It’s a safe starting point that guarantees you cover your expenses on every sale.

-

Competitor-Based Pricing: With this model, you’re looking over your shoulder. You analyze what direct and indirect competitors are charging for similar stuff, then set your price just above, below, or right on par with theirs to strategically position your brand.

-

Value-Based Pricing: This one is all about the customer. It sets prices based on the perceived value your product delivers. It’s less about your costs and more about what your solution is truly worth to the buyer, which can open the door to much higher profit margins.

To give you a clearer picture, here’s a quick breakdown of how these models stack up against each other.

Overview of Core Pricing Models

| Pricing Model | Primary Focus | Best For | Key Challenge |

|---|---|---|---|

| Cost-Plus | Your internal costs and desired profit margin. | Businesses with predictable costs or those new to pricing. | Ignores market demand and what customers are willing to pay. |

| Competitor-Based | The external market and competitor positioning. | Saturated markets where price is a key differentiator. | Can easily lead to a "race to the bottom" on price, eroding margins. |

| Value-Based | The customer's perception of your product's worth. | Innovative or unique products with clear, high-value benefits. | Requires deep customer research to accurately quantify perceived value. |

Looking at this table, it's clear that each model offers a different piece of the puzzle. Relying on just one is a rookie mistake that can leave a lot of money on the table.

Blending Models for a Resilient Strategy

A cost-plus approach might ignore market demand completely, while leaning too heavily on competitor-based pricing can drag you into a price war you can't win. This is why truly effective pricing demands a hybrid approach.

For anyone in the e-commerce game, understanding how pricing feeds into your bigger picture is crucial. You can dive deeper into building a winning framework for your online sales and ecommerce ventures.

The most successful brands don't just pick one pricing model. They blend them. They start with their costs to set a price floor, look at competitors to understand the market, and then layer on value-based principles to maximize what customers are willing to pay.

This integrated mindset creates a pricing strategy that actually works—it covers your bills, positions your brand smartly, and unlocks real growth. To get a feel for different pricing structures, exploring some general pricing information can provide helpful context.

In the next sections, we'll break down each of these elements piece by piece, giving you a clear roadmap to build your own killer pricing strategy from the ground up.

Calculating Your True Cost Per Product

Before you even think about setting a price, you have to get brutally honest about your costs. This isn’t just about the price of raw materials; it’s about digging into every single expense that goes into getting your product into a customer's hands.

Calculating your true cost establishes your absolute price floor. Sell for a penny less than this number, and you’re literally paying people to take your product. This first step is all about building a clear financial picture so you can price for profit from day one.

The Two Buckets of Business Costs

Every single expense your business has can be tossed into one of two buckets: fixed or variable. Getting this right is the key to figuring out your real cost per unit.

- Fixed Costs: These are the consistent, predictable bills you have to pay no matter what. Think of them as the cost of keeping the lights on—rent, software subscriptions, and salaries. They don’t change whether you sell one item or a thousand.

- Variable Costs: These expenses are tied directly to how much you produce. The more you make, the more you spend. This is often called your Cost of Goods Sold (COGS).

Splitting your expenses this way helps you see exactly how much it costs to produce just one more unit, which is where smart pricing begins.

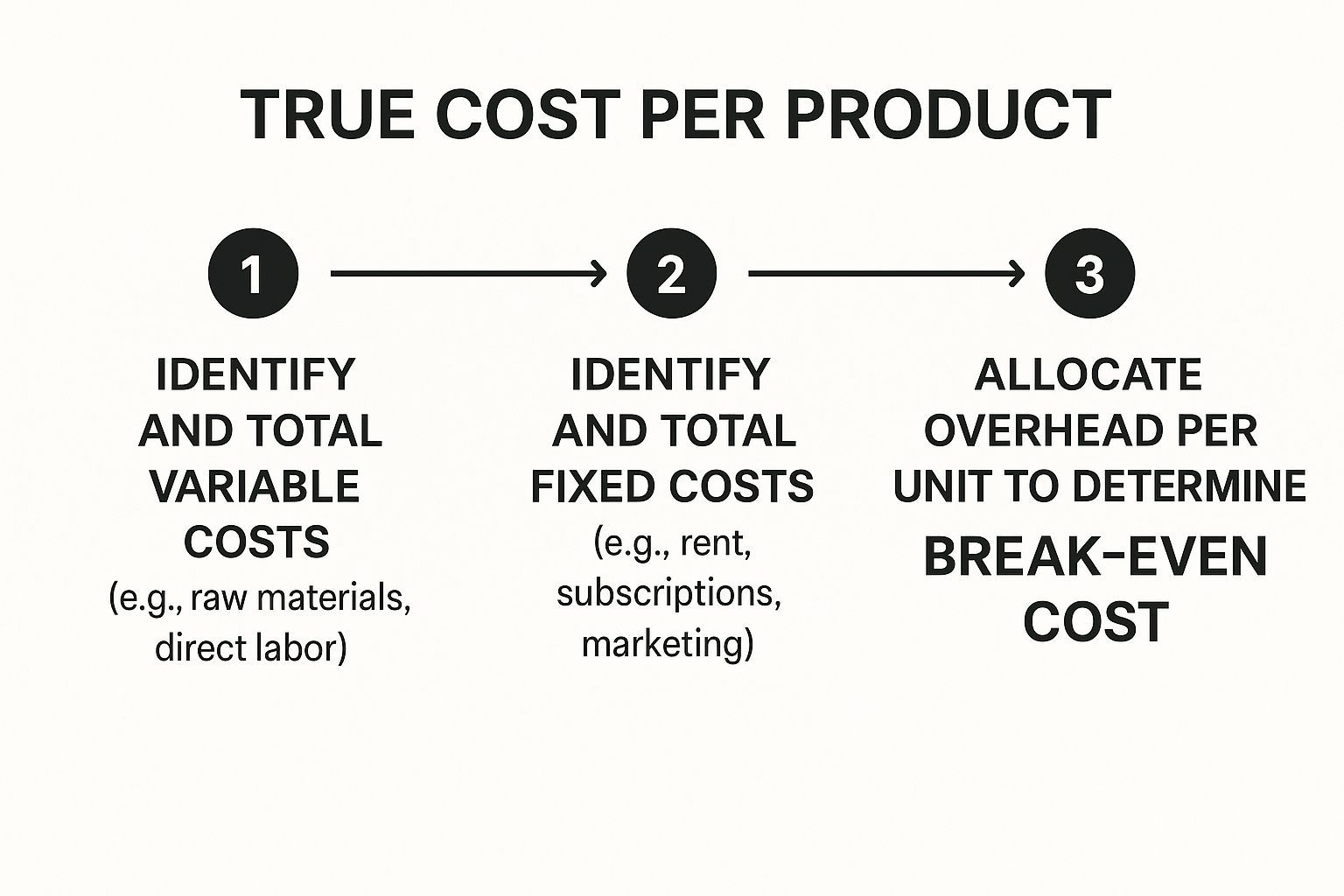

This infographic breaks down how to combine these costs to find your true investment per product.

As you can see, it’s about adding up both your direct production costs and your overhead to get a complete picture.

Putting It Into Practice: An Artisanal Coffee Roaster Example

Let's make this real. Imagine you run a small artisanal coffee roasting business. To figure out your true cost per bag, you need to tally up all your expenses.

First, let's nail down your monthly fixed costs:

- Roastery Rent: $1,500

- Roasting Equipment Lease: $400

- Software (Shopify, Accounting): $150

- Marketing & Advertising Spend: $500

- Total Fixed Costs = $2,550 per month

Next, calculate the variable costs for a single bag of coffee:

- Raw Green Coffee Beans: $4.50

- Printed Coffee Bag: $0.75

- Direct Labor (roasting, bagging): $1.50

- Shipping Box & Materials: $1.00

- Total Variable Cost Per Bag = $7.75

Beyond just the direct costs of making your coffee, finding effective supply chain cost reduction strategies is crucial for keeping these variable expenses as lean as possible.

Allocating Overhead to Find Your Break-Even Point

Now for the important part. You need to spread your fixed costs across every product you sell. If your roastery produces 1,000 bags of coffee this month, the math is pretty simple.

Formula: (Total Fixed Costs / Number of Units Produced) + Variable Cost Per Unit = True Cost Per Unit

Let’s plug in our numbers:

($2,550 / 1,000 bags) + $7.75 = $2.55 + $7.75 = $10.30

This $10.30 is your break-even point. It’s the absolute rock-bottom price you can charge to cover every single expense tied to that bag of coffee. Any cent you charge above this number is your gross profit.

Getting this number right is foundational to building a sustainable business model that's profitable from the start.

Interestingly, this whole idea of a fixed price is a relatively new concept. For centuries, prices were set through haggling or auctions, where real-time demand dictated the value. It wasn't until the 1840s that retailers started using fixed, non-negotiable prices, a move that made the buying process way more straightforward for everyone.

Once you know your true cost per unit, you have the solid ground you need to stand on. Now, you can confidently move on to the next steps: seeing what the market can bear and what your customers are truly willing to pay.

Finding Your Place in the Market Landscape

Setting a price without looking at what the competition is doing is like navigating without a map. Once you’ve nailed down your costs, the next move is to get a handle on the market you’re jumping into. A solid competitive analysis isn't just about avoiding a major pricing blunder; it’s about giving yourself a strategic edge.

This process goes way beyond just peeking at your rivals' price tags. You're digging into their entire value proposition to find your perfect opening.

Identifying Your True Competitors

First things first, your competition isn't just the company selling a nearly identical product. You need to think bigger and pinpoint both the direct and indirect players your customers might be considering.

- Direct Competitors: These are the obvious ones. They sell a similar product to the same audience. If you're selling artisanal coffee beans, other small-batch coffee roasters are your direct competition.

- Indirect Competitors: These businesses solve the same problem for your customer, just with a different solution. For that coffee roaster, this could be the local high-end café, a popular energy drink brand, or even a fancy tea company.

Ignoring your indirect competitors is a rookie mistake that leaves you blind to a huge chunk of the market. Trust me, your customers are comparing you to them, even if you aren't.

Moving Beyond Simple Price Lists

Once you have your list of competitors, the real work starts. Just listing their prices gives you a data point, but it tells you nothing about why they charge what they do. To really understand how to price your product, you have to dig into what customers actually get for that money.

For each competitor, ask yourself:

- How does their product quality stack up against mine?

- Do they offer killer customer support or a generous warranty?

- Is their brand reputation stronger or weaker than what I'm building?

- What unique features or benefits are they shouting about in their marketing?

This deeper dive helps you shift from a basic price comparison to a much more insightful value comparison.

A competitive analysis isn't just about matching prices. It's about understanding the entire value exchange your competitors offer, so you can position your own product to win.

This kind of analysis is key to finding your positioning. If you're trying to make a name for yourself in a crowded field, our guide on how to conduct a marketplace evaluation test offers a structured way to figure out where you stand.

Using Data to Inform Your Pricing Strategy

In today's fast-moving markets, smart competitive pricing leans heavily on historical data. Airlines are a classic example of this in action. They constantly analyze what competitors charged on similar routes in the past to tweak their own fares. If one airline drops its prices, others often follow suit to protect their market share.

This data-driven approach also helps businesses plan promotions and discounts more effectively. By looking at past campaigns, you can figure out what worked and what didn't. Using predictive analytics, companies can pinpoint the best discount levels and timing for special offers, helping them boost sales without killing their margins.

Creating a Value Map to Find Your Opening

A value map is a simple but powerful visual tool. It plots your product against competitors based on two key factors: price (from low to high) and perceived quality (from low to high). By placing your brand and your competition on this map, you can see where everyone stands at a glance.

This exercise almost always reveals strategic opportunities. Is there a gap in the market for a high-quality, mid-priced product? Are all your competitors bunched up in the low-price, low-quality corner, leaving an opening for a premium brand to swoop in?

Let's go back to our artisanal coffee roaster. After mapping the competition, they might see that most local brands are fighting to be the cheapest, while big national brands own the high-price, high-quality space. The strategic opening? A mid-priced offering that delivers way better quality than the budget guys but is more accessible than the national premium brands.

This positioning gives you a compelling marketing message: "Premium quality coffee without the premium price tag." This is how competitive analysis shifts from a defensive chore to an offensive strategy, helping you find that sweet spot where your price feels fair, competitive, and—most importantly—profitable.

Pricing Based on Customer Value, Not Just Cost

While understanding your costs and the competition is a solid start, the most profitable pricing strategies are anchored to one thing: the value your product delivers to your customer. This approach, known as value-based pricing, completely flips the script. You stop asking, "What did this cost me to make?" and start asking, "What is this worth to them?"

This is where you unlock serious profit potential. It’s about pricing your product based on the tangible results and benefits it provides, not just the sum of its parts. Once you learn to put a number on that value, you can confidently set a price that reflects the true impact you're making.

Uncovering What Your Customers Truly Value

Figuring out the perceived value of your product isn't guesswork; it’s about getting inside your customers’ heads. You need direct feedback to understand which benefits really matter to them and what those benefits are worth in their eyes.

There are a few hands-on ways to do this right:

- Customer Surveys: Use simple tools to ask direct questions. Find out which features are most important and what they'd be willing to pay for them. Keep it short and sweet to get the best responses.

- One-on-One Interviews: Nothing beats a real conversation. Talking to a handful of your ideal customers can give you incredible insight into their biggest headaches and how your product makes them go away.

- Conjoint Analysis: This sounds technical, but it’s really about choices. You show customers different product packages (combinations of features and prices) and ask them to pick their favorite. Their answers reveal what's actually driving their buying decisions.

The goal is to pinpoint the specific, high-impact benefits your product offers. Are you saving your customers time? Are you cutting their operational costs? Or are you delivering a unique experience they just can't get anywhere else? These are the value drivers you need to find.

Attaching a Dollar Value to Your Benefits

Once you know what matters to your customers, the next step is to actually quantify it. Let’s walk through a real-world example.

Imagine you've built a SaaS tool that automates weekly reporting for small marketing teams. It pulls data from multiple sources and spits out a clean, insightful report in about five minutes. Without your tool, a marketing manager spends roughly three hours every Friday wrangling spreadsheets to create the same report.

Here’s how you can calculate the tangible value:

- Calculate Time Saved: Your tool saves the manager three hours every single week.

- Assign a Dollar Value: If that marketing manager earns an average of $40 per hour, the value of the time saved is $120 per week ($40/hour x 3 hours).

- Extrapolate the Annual Value: This translates to a staggering $6,240 in saved labor costs per year for that business ($120/week x 52 weeks).

With this data, you can now price your SaaS tool with confidence. A price of $99 per month ($1,188 per year) suddenly seems like an incredible bargain, offering a return on investment of more than 5x.

This is the power of value-based pricing. You’re anchoring your price to the thousands of dollars in value you deliver, not your development costs. For businesses trying to scale, linking price to value is a core part of any effective online marketing strategy.

Communicating Value to Justify Your Price

Knowing your product’s value is only half the battle. You also have to communicate it effectively. Your marketing copy and product descriptions should scream benefits, not just list features.

Instead of saying, "Our tool integrates with multiple data sources," say, "Stop wasting hours manually compiling reports and get your Friday afternoons back." The second message speaks directly to the value you provide, justifying your price point in the customer's mind before they even think to question it.

Ultimately, mastering value-based pricing is about a fundamental shift in perspective. It moves you from a cost-focused mindset to a customer-centric one. By understanding and quantifying the problems you solve, you can set a price that truly reflects your product's worth—paving the way for sustainable and profitable growth.

Testing and Optimizing Your Pricing Strategy

Your first price is never your final price. Think of it as a well-educated hypothesis that needs to be validated with real-world data. Setting a price isn’t a one-and-done task; it’s an ongoing process of launching, monitoring, and refining your strategy to stay aligned with market dynamics and customer expectations.

By creating a continuous feedback loop, you make sure your approach stays optimized for profitability and long-term growth. This is where you really learn how to price a product in an ever-changing environment.

Launching with a Test-and-Learn Mindset

Instead of locking in a price and hoping for the best, launch with the clear intention of gathering data. A great way to gauge the initial market reaction is by using controlled tests that give you clear, actionable insights.

Consider these practical methods to get started:

- Introductory Offers: Launching with a limited-time discount can attract early adopters and give you a sense of demand without permanently devaluing your product. It’s a low-risk way to see if customers are even interested.

- A/B Testing Price Points: This is a powerful technique for ecommerce. You can show two different prices to two different segments of your website visitors and measure which one converts better. For example, does a $49 price point get more sales than $55?

These initial tests are invaluable. They move you from relying on assumptions to making decisions based on actual customer behavior—a crucial step for anyone looking to improve their online sales. For marketplace sellers, understanding these dynamics can significantly boost performance, and you can learn more about how to improve your Amazon sales to see these principles in action.

Key Metrics to Monitor Closely

Once your price is live, you need to become a detective. Your goal is to understand how your pricing affects customer actions and your bottom line. Don't just look at revenue; a higher price might bring in more money per sale but scare away so many customers that your total profit drops.

Watch these key metrics like a hawk:

- Conversion Rate: The percentage of visitors who make a purchase. A sudden drop might mean your price is too high.

- Sales Volume: How many units are you selling? This, combined with conversion rate, tells a powerful story about demand.

- Cart Abandonment Rate: If people are adding your product to their cart but not checking out, price is a likely culprit.

- Customer Feedback: Pay attention to what people are saying in reviews, surveys, and support tickets. This qualitative feedback often reveals the "why" behind the numbers.

Your data tells a story about your pricing. A low conversion rate with high traffic could be a price signal, while high sales volume with low margins indicates you might be leaving money on the table.

This continuous monitoring is where historical data becomes your secret weapon. By analyzing past transaction records, a good pricing manager can segment sales into micro-markets to see which factors drive price variations and predict what will work next. This granular analysis leads to smarter, more tailored pricing that ultimately improves profit margins.

Embracing Psychological Pricing Tactics

Beyond the hard numbers, human psychology plays a massive role in how a price is perceived. These aren't cheap tricks; they are time-tested methods for framing your price in a more appealing way.

Here are two powerful tactics you can test right away:

- Charm Pricing: The classic strategy of ending a price in "9" or "99" (e.g., $19.99 instead of $20). The left-digit effect makes the price feel significantly lower than it actually is, even if it's just a one-cent difference.

- Price Anchoring: This involves showing a higher "original" price next to the current one (e.g., "Was $100, Now $75"). The initial, higher price acts as an anchor, making the current price seem like a fantastic deal in comparison.

Testing these tactics is surprisingly straightforward. You can run an A/B test comparing a charm price to a rounded price and see which one drives more sales. The market is always changing, and your pricing strategy should evolve with it. By consistently testing, monitoring, and optimizing, you transform pricing from a static decision into a dynamic tool for growth.

Even after you’ve nailed down your costs, checked out the market, and figured out your value, pricing can still feel like a moving target. Things get messy in the real world. Let’s walk through a few of the most common pricing headaches that pop up and how to handle them.

One of the biggest traps is discounting. Sure, a good sale can bring people in the door, but if you’re not careful, you can train your customers to never, ever pay full price. Suddenly, your brand’s perceived value is shot.

The trick is to be strategic. Don’t just slash prices randomly. Tie your promotions to specific events, like a holiday or a new product drop. This builds a sense of urgency without making discounts the new normal.

How Should I Handle Discounts and Promotions

The goal here is to use discounts as a surgical tool, not a sledgehammer. Overdo it, and you’ll destroy your profit margins and teach customers that your regular prices are a joke.

Here are a few smarter ways to approach promotions:

- Bundle products. Instead of marking down your hero product, package it with a couple of related items for an attractive price. This bumps up your average order value and protects the perceived worth of each individual item.

- Offer tiered deals. Think "buy two, get one 50% off." This kind of offer encourages people to buy more, rather than just waiting for a simple price cut on a single product.

- Use targeted codes. Send unique, one-time discount codes to specific groups, like first-time buyers or your most loyal customers. It makes the offer feel exclusive and earned, not just a desperate plea for a sale.

When Should I Raise My Prices

Raising your prices feels scary. No one wants to alienate their customers. But sticking with your launch price forever is a surefire way to leave money on the table, especially as your own costs for materials, shipping, and labor creep up.

The key is transparency. Be upfront about it and explain why it's happening. People are a lot more understanding when they know the reason behind an increase.

A price increase isn't just about covering your own rising costs. It's about reinvesting in the product and the experience you provide. Frame it that way.

For instance, if your raw material costs jumped by 15%, let your customers know. Explain that a small price adjustment allows you to keep using the same high-quality components they expect from you. It shifts the narrative from "we want more profit" to "we're committed to quality."

What If My Price Is Significantly Higher Than Competitors

Being the most expensive option on the market isn’t a bad thing—it's a bold statement. But if you're going to charge a premium, you better be able to back it up with superior value. You have to give customers a clear reason to choose you.

That justification can come from a few places:

- Superior Quality: You use better materials, your craftsmanship is impeccable, or your ingredients are top-notch.

- Exceptional Service: You offer a killer warranty, lightning-fast customer support, or an incredibly smooth user experience.

- Unique Features: Your product does something that nobody else’s can.

Your marketing has to hammer this point home, relentlessly. When customers truly understand what they’re getting for that higher price, they won’t see it as an overcharge. They’ll see it as a smart investment.

At Next Point Digital, we help brands build pricing and marketing strategies that highlight their unique value, turning clicks into profitable sales. Learn how our ecommerce expertise can help you grow.