Calculating customer lifetime value is all about figuring out the total amount of money you can expect from a customer over their entire relationship with your brand. The simplest way to get a quick read on this is by multiplying your average purchase value by the average purchase frequency, and then by the average customer lifespan.

This gives you a solid, no-frills baseline for understanding what your customers are really worth in the long run.

Why Customer Lifetime Value Is Your Most Important Metric

Forget about clicks, impressions, and other fleeting metrics. If you want to build a business that lasts, Customer Lifetime Value (CLV) is the one number that truly deserves your attention.

CLV shifts your entire focus from one-off sales to long-term relationships, revealing the real financial impact of keeping customers happy. Nailing this metric is the foundation of any good data-driven growth strategy because it helps you turn raw numbers into actual, tangible results.

When you know what a customer is worth, you can finally make smarter, more profitable decisions across your entire business. It stops being an abstract number and becomes your strategic roadmap.

The Strategic Power of Knowing Your CLV

Calculating your CLV gives you a much deeper understanding of your business's health and shines a light on the clearest path for growth. It has a direct impact on everything from how you set your marketing budgets to which products you decide to develop next.

Here’s why it’s such a big deal:

- Smarter Marketing Spend: CLV tells you exactly how much you can afford to spend to acquire a new customer (your Customer Acquisition Cost, or CAC) and still make a profit. A healthy CLV:CAC ratio is widely considered to be 3:1—meaning you make three times what you spend to get a customer.

- Improved Profitability: We’ve all heard it: keeping an existing customer is way cheaper than finding a new one. When you focus on strategies that boost CLV, like improving customer service or launching a loyalty program, you're directly pumping up your bottom line.

- Enhanced Customer Retention: By identifying your most valuable customers, you can stop guessing and start creating targeted retention campaigns and personalized experiences that actually keep them coming back.

- Informed Business Decisions: Good CLV data helps you decide which products to push, which customer service efforts to fund, and how to properly scale an ecommerce business by focusing on what creates real, sustainable value.

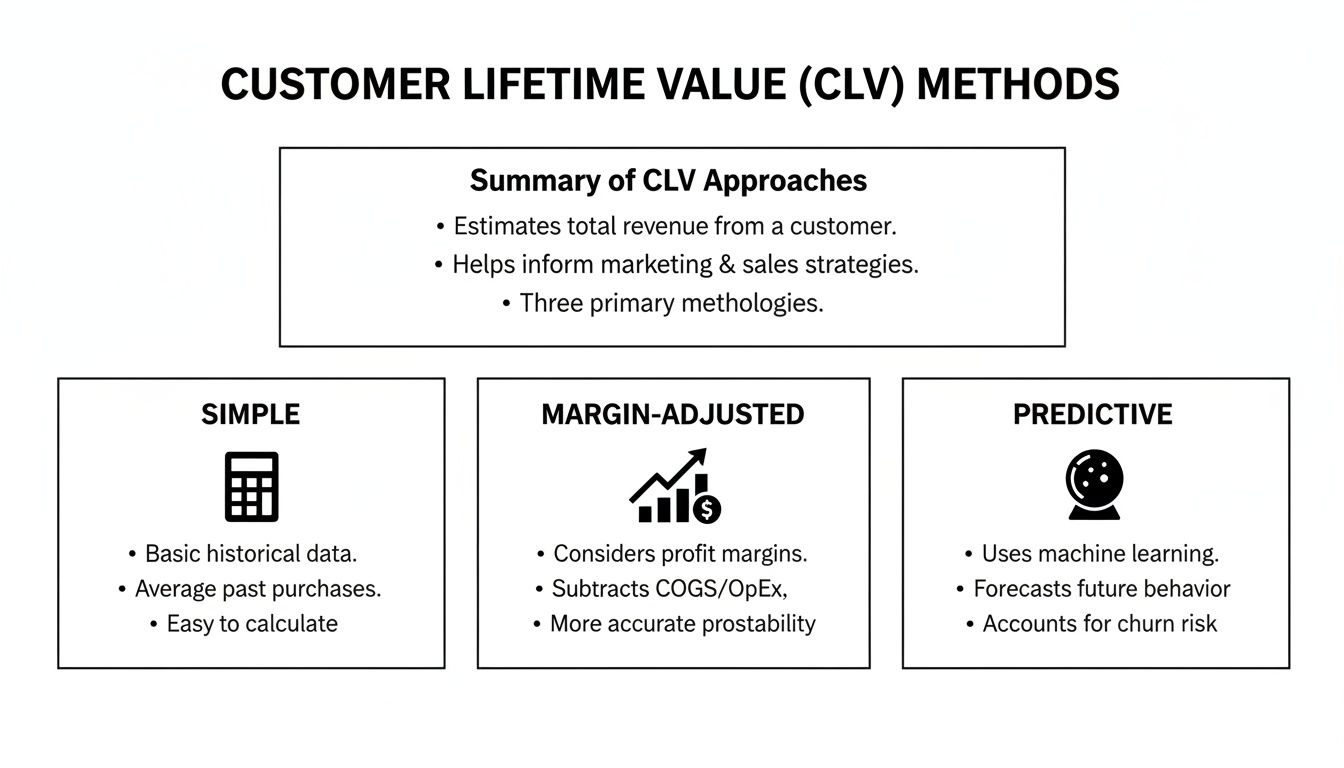

The infographic below breaks down the three main ways to calculate customer lifetime value, each giving you a different level of accuracy and insight.

From a quick-and-dirty simple formula to a more sophisticated, forward-looking predictive model, each method gets you closer to a refined understanding of customer worth. By the time you're done with this guide, you’ll know exactly which one to pick and how to apply it to your business.

Your Starting Point: The Simple CLV Formula

Jumping into customer lifetime value doesn’t require a data science degree. The easiest way to get started is with the simple CLV formula, which gives you a quick, high-level snapshot of what your customers are actually worth. It’s the perfect first step for any business ready to move beyond surface-level metrics.

The formula is pretty straightforward and uses data you probably already have on hand.

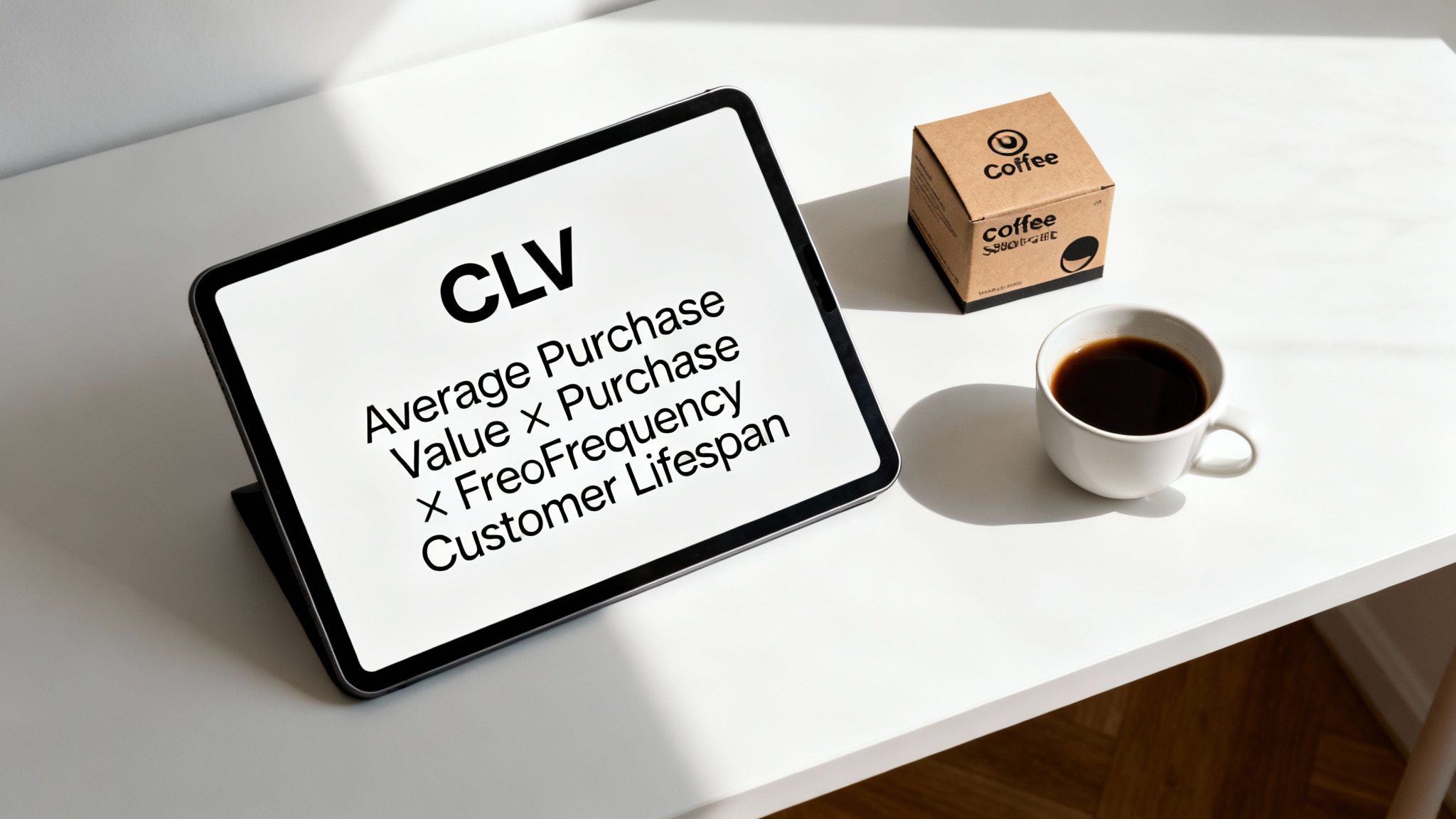

Simple CLV Formula: (Average Purchase Value × Purchase Frequency) × Customer Lifespan

This calculation spits out the total revenue you can expect from an average customer over their entire time with your brand. It's a foundational metric that has helped businesses make smarter decisions for decades.

Breaking Down the Components

To run this calculation, you only need to find three key numbers. Most ecommerce platforms like Shopify or a CRM like HubSpot will have this data waiting for you in their analytics dashboards.

- Average Purchase Value (APV): This is just the average amount a customer spends per order. To get it, divide your total revenue over a set period (say, a year) by the total number of orders from that same period.

- Purchase Frequency (PF): This tells you how often the average customer buys from you in that period. You calculate it by dividing the total number of orders by the number of unique customers.

- Customer Lifespan (CL): This is the average amount of time a customer sticks around and keeps buying from you before they churn. For newer businesses, you might have to estimate this at one to three years. More established brands can pull this from historical data for a more accurate figure.

Once you have those three numbers, you just multiply them together to get your first CLV estimate.

A Coffee Subscription Box Example

Let's make this real. Imagine you run "Morning Ritual," a direct-to-consumer coffee subscription box. You pull up your sales data from the last year to find your numbers. If you're selling on a marketplace, you can check out guides on analyzing your Amazon sales data to find similar figures.

Here’s what your data shows:

- Average Purchase Value: Your total revenue for the year was $150,000 from 3,000 orders. That makes your APV $50 ($150,000 / 3,000).

- Purchase Frequency: Those 3,000 orders came from 750 unique customers. Your PF is 4 purchases per year (3,000 / 750).

- Customer Lifespan: On average, your subscribers stick around for 3 years.

Now, let's plug these into the formula:

$50 (APV) × 4 (PF) × 3 (CL) = $600

Your simple CLV is $600. This means you can expect the average customer to generate $600 in revenue over their three-year relationship with your coffee brand. That number is immediately useful for things like setting marketing budgets or figuring out how much you can spend to acquire a new customer.

This simple formula has been a business staple since the early 2000s, and for good reason. Small businesses that use this basic calculation often see a 20-30% improvement in their marketing budget allocation, just by being able to identify and focus on higher-value customer segments. For instance, Starbucks used a similar model to figure out their loyal customers were worth an average of $14,000 over two decades, which completely changed how they approached retention.

Pros and Cons of the Simple Method

This formula is a great place to start, but you need to know its limitations.

The Good:

- It’s Fast and Easy: You can get a baseline CLV in minutes using data you already have.

- It’s a Great Benchmark: It gives you a clear, simple metric you can track over time to see if you're improving.

The Not-So-Good:

- It Ignores Profitability: This formula is all about revenue, not profit. It doesn't factor in your Cost of Goods Sold (COGS), so it can easily overstate how valuable a customer truly is.

- It Uses Averages: The calculation relies on broad averages, which can mask huge differences between your best customers and your one-and-done shoppers.

Even with its flaws, the simple formula is the best first step on your analytics journey. It gives you a real number to work with and sets you up for more advanced calculations down the road. To get a better handle on the core methodology, check out this guide on how to calculate lifetime value (LTV) for your ecommerce business.

Adding Profitability with Margin-Adjusted CLV

While the simple CLV formula gives you a great starting point, it has one major blind spot: it treats all revenue as equal. But revenue doesn't pay the bills—profit does.

To get a truly accurate picture of what a customer is worth, you need to factor in your costs. This is where the margin-adjusted CLV comes into play. It refines your calculation by introducing Gross Margin, giving you a much more realistic view of the actual profit each customer generates over their lifetime.

Why Gross Margin Matters

Gross Margin tells you what percentage of revenue you keep as profit after accounting for the Cost of Goods Sold (COGS). COGS includes all the direct costs of creating your product, like raw materials, manufacturing, and shipping supplies.

By subtracting these costs, you move from a top-line revenue figure to a bottom-line profit figure. This distinction is critical for making smart business decisions. A customer who generates $1,000 in revenue but costs you $800 to serve is far less valuable than one who generates $700 in revenue but only costs $200.

Calculating Your Gross Margin

Figuring out your gross margin is pretty straightforward. You just need two pieces of information from your accounting records: your total revenue and your total COGS over a specific period.

The formula is simple:

Gross Margin (%) = [(Total Revenue – COGS) / Total Revenue] × 100

For example, let's say your coffee subscription box business, "Morning Ritual," made $150,000 in revenue last year. Your COGS (coffee beans, boxes, packaging) was $60,000.

Your calculation would look like this:

[($150,000 – $60,000) / $150,000] × 100 = 60%This means for every dollar in sales, you keep 60 cents as gross profit. Getting this number right is a key part of your overall strategy, especially when you need to determine the price of a product to ensure profitability from day one.

The Margin-Adjusted CLV Formula

Once you have your gross margin, you can plug it directly into your CLV formula. This gives you a much clearer, profit-focused perspective.

Margin-Adjusted CLV = Simple CLV × Gross Margin

Or more detailed: [(Average Purchase Value × Purchase Frequency) × Customer Lifespan] × Gross Margin

This calculation, often called the Gross Margin CLV model, is powerful because it directly ties customer value to profitability. It’s not just a theoretical exercise, either. One study found that e-commerce firms incorporating gross margin into their CLV saw a 42% better return on their retention campaigns compared to those using simpler, revenue-only models.

Recalculating with Our Coffee Box Example

Let's go back to our "Morning Ritual" coffee subscription business. From the previous section, we figured out the simple, revenue-based CLV was $600.

- Simple CLV: $600

- Gross Margin: 60% (or 0.60)

Now, let's apply the margin-adjusted formula:

$600 (Simple CLV) × 0.60 (Gross Margin) = $360

This single adjustment reveals a crucial insight. While the average customer generates $600 in revenue, they only contribute $360 in actual gross profit to your business over their lifetime.

This profit-based figure is the number you should be using to make strategic decisions, especially when it comes to your marketing budget and Customer Acquisition Cost (CAC).

Knowing your margin-adjusted CLV is $360 gives you a hard limit for your CAC. If you’re aiming for a healthy 3:1 LTV:CAC ratio, you shouldn't spend more than $120 to acquire a new customer. Relying on the revenue-based CLV of $600 might have led you to believe you could spend up to $200—a mistake that would have quickly eaten into your real profits. This simple shift in perspective is what separates businesses that grow from those that just spin their wheels.

Forecasting Growth with Predictive CLV Models

So far, we’ve looked at customer lifetime value through a historical lens. We've used past data to figure out what an average customer has been worth. While that’s incredibly useful, it’s a bit like driving while looking only in the rearview mirror.

Predictive CLV flips the script. Instead of looking backward, it uses data to forecast what your customers are likely to do in the future.

This approach moves beyond simple averages to build a much more dynamic, forward-looking picture of customer value. It helps you spot your future superstars and identify at-risk customers before they churn, letting you step in and do something about it.

Unpacking the Predictive Model

Predictive CLV models can get pretty complex, often wading into machine learning territory, but the core idea is straightforward. They analyze individual customer behaviors—like how often they buy, the time between purchases, and order values—to predict future actions. Instead of lumping all customers together, this model gets that each one is on a unique journey.

A simplified predictive formula might look something like this:

Predictive CLV = (Avg. Monthly Revenue × Gross Margin) / (Churn Rate + Discount Rate)

Let's break down the new terms here, since they’re the key to calculating CLV with a forward-looking perspective.

- Churn Rate: This is the percentage of customers who stop buying from you over a given period. It's a direct measure of customer attrition and a critical piece of the puzzle for predicting how long a customer relationship will last.

- Discount Rate: This is an accounting concept that accounts for the time value of money. In short, a dollar today is worth more than a dollar a year from now. A typical discount rate for a stable business might be 10-15% annually.

By baking these factors into the calculation, the model gives you a much more realistic present-day value of a customer's future profit. It answers the big question: "What is the future profit from this customer worth to me right now?"

Why Predictive CLV Is a Game Changer

The real power here is in driving proactive, personalized marketing. Because it works on a much more granular level, predictive CLV unlocks strategies that historical averages just can't touch. These kinds of forward-thinking approaches are central to many modern data-driven marketing strategies.

Here’s what this model really lets you do:

- Identify High-Potential Customers Early: You can spot new customers who show behaviors similar to your existing VIPs. From day one, you can start nurturing them with personalized offers and extra attention.

- Segment Customers by Future Value: Go way beyond simple segmentation. You can create groups like "High-Potential, Low-Engagement" or "At-Risk VIPs" and tailor your retention campaigns to get them back on track.

- Optimize Marketing Spend with Precision: Instead of applying one LTV:CAC ratio across the board, you can justify spending more to acquire customers who are predicted to have a much higher lifetime value.

- Forecast Revenue More Accurately: By adding up the predictive CLV of all your customers, you can build a much more reliable forecast for future revenue streams.

This approach to CLV has seen a huge uptick in adoption. A Forrester report noted a 150% surge in its use among Fortune 500 firms. Even better, a cohort study of 1,000 e-retailers showed its power when predictive models flagged a 28% churn spike during the holidays, saving an estimated $2.5 billion in lost value. To see how leading companies apply this, you can explore more insights about customer lifetime value use cases.

Is Your Business Ready for Predictive CLV?

While it’s powerful, predictive modeling isn't for everyone. It requires a certain level of data maturity and the right tools to pull it off effectively.

Key Takeaway: Jumping to predictive CLV without a solid data foundation is like trying to run a marathon without training. Start with the simpler models to build your data muscles first.

Your business might be ready to explore predictive CLV if:

- You have at least one to two years of clean, detailed transaction history for your customers.

- You can track individual customer behaviors across multiple touchpoints (website visits, email opens, purchases).

- You have access to analytics tools capable of running more complex calculations, or a data analyst on your team.

For many businesses, starting with the simple and margin-adjusted CLV models is the right move. Once you’ve mastered those and have solid data collection practices in place, stepping up to a predictive model is the natural next step to really sharpen your growth strategy.

Putting Your CLV Data into Action

Calculating customer lifetime value is a huge step, but the real power comes from turning that number into a strategic advantage. Knowing your CLV is like having a roadmap; it shows you exactly where to invest your time, money, and effort for maximum return.

This is where the numbers on your spreadsheet translate into tangible business growth.

The data you've gathered is your key to making smarter decisions everywhere, from your daily ad bids to your long-term product development plans.

Optimize Your Marketing Spend and Acquisition

One of the most immediate ways to use CLV is to refine your marketing budget. It gives you a clear ceiling for your Customer Acquisition Cost (CAC), ensuring you’re not just making sales, but making profitable sales.

The gold standard for a healthy ecommerce business model is the 3:1 LTV:CAC ratio. This means for every dollar you spend to acquire a new customer, you should be generating at least three dollars back over their lifetime.

- LTV:CAC is > 3:1: This is a great position to be in. It’s a green light to get more aggressive with your marketing spend and start capturing more market share. You can confidently increase bids or test out new acquisition channels.

- LTV:CAC is < 3:1: This is a major red flag. You're likely overspending to acquire customers who aren't valuable enough to justify the cost. The solution is simple: either lower your CAC or find ways to increase your LTV.

With a firm grasp on this ratio, you can fine-tune your ad campaigns with serious precision. On platforms like Google Ads or Meta, you can set target Cost Per Acquisition (CPA) bids based on the actual value of the customers you're targeting. If you know customers from a specific campaign have a higher CLV, you can justify bidding more to bring them in.

Segment Customers for Personalized Experiences

Your CLV isn't a single, static number; it varies wildly across your customer base. A small percentage of your customers likely drives a huge portion of your revenue. Identifying these high-value customers is the first step toward keeping them loyal for the long haul.

Start by segmenting your customer list into tiers based on their CLV:

- VIPs (Top Tier): These are your brand champions. They spend the most and buy the most often.

- Loyal Customers (Mid Tier): These are the consistent buyers who form the reliable backbone of your business.

- Occasional Shoppers (Low Tier): These customers buy infrequently or stick to low-value orders.

Once you have these segments, you can finally stop using one-size-fits-all marketing. Your VIPs shouldn't be getting the same generic email blast as a first-time buyer. Tailoring your communication and offers makes each group feel understood and valued, which is the entire game when it comes to retention.

Expert Tip: Don't just focus on your VIPs. Your mid-tier customers often have the highest potential for growth. A well-timed offer or a personalized recommendation can be all it takes to turn a loyal customer into a VIP.

For instance, you could roll out an exclusive loyalty program for your top-tier customers, giving them perks like early access to new products, free shipping, or a dedicated support line. For your mid-tier segment, you might focus on cross-selling campaigns to introduce them to other products they’ll love. Understanding these behaviors is much easier with the right ecommerce personalization software, which can automate many of these tailored experiences.

Inform Product Development and Business Strategy

Your most valuable customers are a goldmine of information. Their purchasing habits tell you exactly what’s working and where you should focus your energy next.

Analyze the products your high-CLV customers buy most often. Are there common themes? Do they tend to purchase certain items together? This data should directly inform your product development pipeline. If you see your best customers consistently buying a particular type of product, it's a strong signal to develop more variations or complementary items.

This approach also helps you manage your inventory more effectively. You can ensure your most popular items among high-value segments are always in stock while potentially phasing out products that are only ever purchased by low-CLV, one-time buyers.

Ultimately, putting your CLV data into action is about shifting from a reactive to a proactive mindset. Instead of just reporting on past sales, you're using customer value to predict future behavior and shape your business strategy for sustainable, long-term growth.

Common Questions About Calculating CLV

Once you start using CLV as a strategic tool, the practical questions are bound to pop up. This metric opens the door to smarter marketing and better business decisions, but only if you know how to interpret and apply it correctly. Let's tackle some of the most common questions that come up once you start digging into customer lifetime value.

What Is a Good LTV to CAC Ratio?

One of the most powerful ways to use CLV is to compare it against your Customer Acquisition Cost (CAC). This ratio is the gut check that tells you if your marketing is actually profitable in the long run.

A widely accepted benchmark for a healthy, growing business is a 3:1 LTV to CAC ratio. This means for every dollar you spend to acquire a new customer, you get three dollars back in lifetime value. It's the sweet spot that signals you've got a sustainable growth engine.

But different ratios tell different stories:

- A 1:1 ratio is a red flag. You're basically spending all your profit just to get a customer in the door. It's an unsustainable model.

- Anything less than 3:1 suggests you might be overspending on acquisition or have a leaky bucket when it comes to retention. It’s a clear signal to either lower your CAC or work on increasing customer value.

- Ratios higher than 4:1, while looking great on paper, could mean you're underinvesting in marketing and leaving growth opportunities on the table. You can probably afford to spend more to capture additional market share.

How Often Should I Recalculate CLV?

Your CLV isn't a "set it and forget it" number. Customer behavior shifts, market conditions change, and your own strategies evolve—so your CLV needs to be refreshed to stay relevant.

How often you do this really depends on your business model:

- For fast-moving ecommerce or D2C brands: Recalculating quarterly is a good rhythm. It lets you adapt quickly to shifts in buying habits or see the impact of recent marketing campaigns.

- For subscription-based businesses (SaaS): An annual or semi-annual recalculation often works well, since customer lifecycles are typically longer and more stable.

- After major business changes: Always recalculate your CLV after big events like a pricing update, a new flagship product launch, or entering a new market.

Recalculating CLV regularly ensures your strategic decisions are based on the most current and accurate data about your customers' value, preventing you from operating on outdated assumptions.

What Tools Can Help Me Calculate CLV?

You don’t need a massive analytics department to get started. The right tool really just depends on the complexity of the CLV formula you're using and how much data you're wrangling.

Here’s a breakdown of the common options:

- Spreadsheets (Google Sheets or Excel): These are perfect for the simple and margin-adjusted CLV formulas. They're accessible, free, and ideal for businesses just starting to track their metrics.

- CRM and Ecommerce Platforms (HubSpot, Shopify): These platforms often have built-in analytics that can automatically calculate metrics like average purchase value and purchase frequency, which simplifies the whole process.

- Dedicated Analytics Platforms (Glew, Baremetrics): For more advanced predictive CLV modeling, these tools are the way to go. They integrate with your sales data, track cohorts, and provide deeper insights with minimal manual work, taking the complexity out of forecasting.

Ready to turn your customer data into a clear roadmap for profitable growth? Next Point Digital specializes in data-driven marketing that optimizes your entire sales funnel, from acquisition to retention. We help ecommerce brands like yours make smarter decisions that boost CLV and scale your business sustainably.

Find out how we can help you convert clicks into loyal customers at https://npoint.digital.