Figuring out your marketing return on investment (ROI) is how you prove your campaigns are actually working. At its simplest, the formula is pretty straightforward: take the sales growth you got from a campaign, subtract what you spent on marketing, and then divide that number by your marketing cost. This gives you a clear picture of what you’re getting back for every dollar you put in.

Understanding Marketing ROI in Ecommerce

Marketing ROI is more than just another metric—it’s the language of growth. Whether you’re selling on Amazon, Walmart, or your own D2C site, knowing your numbers is what separates the brands that scale profitably from the ones just burning cash. It’s time to move past vanity metrics like clicks and impressions and start making smart, data-driven decisions that actually grow your bottom line.

Think of ROI as your strategic compass. It helps you answer the big questions:

- Which ad channels are bringing in the most profitable customers?

- Should we double down on Google Ads or test out that new influencer partnership?

- Did our last email campaign actually drive sales, or did we just get a bunch of opens?

Answering these accurately means you need a solid handle on the inputs. You can’t calculate anything meaningful without gathering the right data first. For a deeper dive, this guide on how to calculate marketing ROI and prove its value offers some great additional context.

The Core Components for Your Calculation

Before you start plugging numbers into a formula, you need to get your data organized. Think of this as your pre-flight checklist—getting these pieces right from the start ensures your calculations are accurate and useful.

Here’s a quick breakdown of what you'll need to pull together.

Core Components of a Basic Marketing ROI Formula

| Component | What It Is | Where to Find It |

|---|---|---|

| Sales Growth | The increase in revenue you can directly tie to a marketing campaign. | Your ecommerce platform (Shopify, BigCommerce) or marketplace dashboard (Amazon Seller Central, Walmart Seller Center). |

| Marketing Cost | The total amount you spent on a specific marketing campaign or channel. | Your ad platform dashboards (Google Ads, Meta Ads), agency invoices, or internal expense trackers. |

| Time Period | The specific timeframe you’re measuring both costs and sales growth over. | This should line up with your campaign's start and end dates. |

Having these components organized is the first step. It makes sure that when we move into more advanced, profit-focused calculations, you’re starting with clean, reliable numbers. This kind of discipline is a core part of the best ecommerce marketing strategies, because it ties what you do directly to what you earn.

The goal isn't just to measure ROI but to use it as a feedback loop. Consistently tracking this metric allows you to spot underperforming campaigns early, shift your budget to the strategies that are actually working, and make your marketing more efficient over time.

Mastering the Essential Marketing ROI Formulas

Ready to get your hands dirty? Let's move from theory to the actual formulas every ecommerce brand needs to have in its back pocket. We’ll break down three different ROI calculations, each built to answer a specific strategic question.

Think of these formulas as different lenses. One gives you a quick, wide-angle view of a campaign. Another zooms in on actual profit. The third uses a telephoto lens to see far into the future value of your efforts. Getting comfortable with all three will help you make smarter, more profitable decisions, whether you're running a Walmart PPC campaign or a new promotion on eBay.

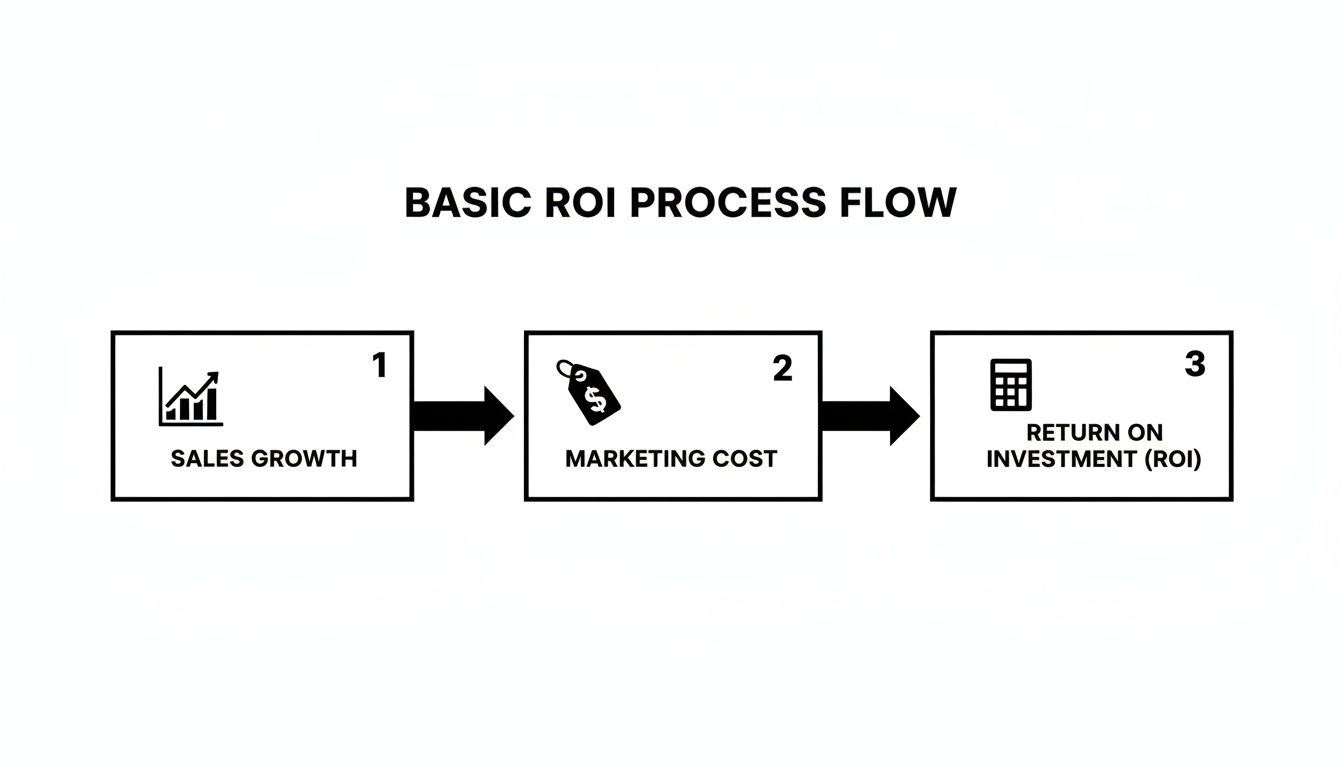

This simple flowchart shows the basic data you'll need for any foundational ROI calculation.

As you can see, the process always starts by tying your sales growth directly to your marketing costs. That’s what gives you a clear, honest ROI figure.

The Simple Sales Growth Formula

This is the most direct way to calculate ROI and should be your go-to for a quick pulse-check on a campaign. It’s perfect for measuring the immediate lift from a specific promotion, like a flash sale you advertised on social media or a new Amazon Sponsored Products campaign.

The classic formula is: (Sales Growth – Marketing Cost) / Marketing Cost. Multiply the result by 100 to get a percentage. It’s simple, but you’d be surprised how many brands don't track it consistently.

Example: An eBay Promoted Listings Campaign

Let's say you sell handcrafted leather wallets and decide to run an eBay Promoted Listings Standard campaign to get more eyes on a new product line.

- Marketing Cost: You spend $500 on ad fees for the month.

- Sales Growth: Your eBay analytics show the campaign brought in $2,500 in sales you otherwise wouldn't have made.

- Calculation: (($2,500 – $500) / $500) * 100 = 400%

A 400% ROI is fantastic. It means for every dollar you put into that eBay promotion, you got $4 back. It’s a powerful, no-fluff metric for evaluating short-term success.

The Gross Profit ROI Formula

The simple formula is great for measuring top-line revenue, but it doesn’t tell you a thing about profitability. You can have massive revenue and still be losing money if your margins are thin. That’s why the Gross Profit ROI formula is non-negotiable for any business that sells physical products.

This calculation factors in your Cost of Goods Sold (COGS)—the direct costs of producing your products, like raw materials and manufacturing. Subtracting COGS gives you a much truer picture of whether a campaign actually made you money.

Formula: (Gross Profit from Campaign – Marketing Cost) / Marketing Cost * 100

Example: A Walmart PPC Campaign

Imagine you sell coffee beans and launch a PPC campaign on Walmart Connect for your new single-origin roast.

- Marketing Cost: You invest $2,000 in the campaign.

- Sales Growth: The campaign drives $8,000 in sales.

- Cost of Goods Sold (COGS): The beans, packaging, and labor for those sales cost you $3,000.

- Gross Profit: First, find your gross profit: $8,000 (Revenue) – $3,000 (COGS) = $5,000.

- Calculation: (($5,000 – $2,000) / $2,000) * 100 = 150%

Your Gross Profit ROI is 150%. A simple ROI calculation would have shown 300%, but this number is the one that matters. It confirms the campaign was genuinely profitable after accounting for the cost of the coffee itself. Getting your COGS right starts with smart pricing, and our guide on how to determine the price of a product is a great place to start.

The Customer Lifetime Value (CLV) ROI Formula

The first two formulas are perfect for looking at individual campaigns, but what about the long game? Some of your best marketing efforts won’t pay off right away, especially campaigns designed to bring in new customers who will (hopefully) buy from you again and again.

The CLV ROI formula helps you justify higher upfront acquisition costs by focusing on the long-term value a new customer brings. It’s a total mindset shift from one-off sales to building sustainable customer relationships.

Formula: (CLV * New Customers Acquired – Marketing Cost) / Marketing Cost * 100

Example: An Amazon DSP Campaign

Your skincare brand runs a top-of-funnel Amazon DSP campaign to introduce your products to new audiences.

- Marketing Cost: The campaign costs $10,000.

- New Customers Acquired: You bring in 50 new customers.

- Customer Lifetime Value (CLV): From your data, you know the average customer spends $400 with your brand over their lifetime.

- Total Lifetime Value Generated: $400 (CLV) * 50 (New Customers) = $20,000.

- Calculation: (($20,000 – $10,000) / $10,000) * 100 = 100%

A simple ROI calculation might have shown this campaign as a loser. But looking at it through the CLV lens, you see a 100% ROI, proving its long-term value. This is the formula that gives you the confidence to invest in brand-building activities that create loyal, repeat buyers—the absolute bedrock of a successful ecommerce business.

Applying ROI Calculations in the Real World

Formulas on a page are one thing, but using them to make confident business decisions is another game entirely. It's time to move beyond the theory and walk through two scenarios that ecommerce brands face every single day.

Seeing how to calculate marketing ROI in context is where the real learning happens. These examples will show you not just what to calculate, but how to account for the hidden costs and nuances that can make or break your profitability. We'll dissect a campaign on a major marketplace and then trace a customer journey to a direct-to-consumer store, highlighting the different variables at play.

Dissecting an Amazon Sponsored Products Campaign

Imagine you sell premium yoga mats. To get some traction for a new eco-friendly line, you launch an Amazon Sponsored Products campaign. At the end of the month, you pull the numbers from your advertising dashboard and see what looks like a home run.

- Ad Spend: You spent $2,000 on clicks.

- Ad-Attributed Sales: The campaign generated $10,000 in sales.

A simple ROAS (Return on Ad Spend) calculation gives you 5x ROAS ($10,000 / $2,000). Fantastic, right? Not so fast. That number is dangerously incomplete because it ignores the actual cost of selling on Amazon and producing your mats in the first place.

To get a true ROI, you have to dig deeper. This is where the Gross Profit ROI formula becomes absolutely essential for any product-based business. For ecommerce brands chasing long-term profits, this formula—ROI = (Gross Profit from Campaign – Marketing Cost) / Marketing Cost × 100—is a game-changer because it forces you to account for your Cost of Goods Sold (COGS). Ignoring COGS can lead to a 2-3x overestimation of your actual ROI.

Let's recalculate with the real numbers:

- Cost of Goods Sold (COGS): Your yoga mats have a 40% COGS. So, for $10,000 in sales, your product cost is $4,000.

- Amazon Referral Fees: Amazon takes a 15% referral fee on each sale, which comes out to $1,500 ($10,000 * 0.15).

- Total Costs: Your true cost is $2,000 (Ads) + $4,000 (COGS) + $1,500 (Fees) = $7,500.

- Net Profit: Your actual profit from this campaign is $10,000 (Sales) – $7,500 (Total Costs) = $2,500.

- True ROI: ($2,500 / $2,000 Ad Spend) * 100 = 125%.

Your real ROI is 125%, not the 400% a simple sales-based formula might suggest. This is still a healthy, profitable campaign, but it gives you a much more sober and actionable number for making future budget decisions.

Key Takeaway: Always look beyond surface-level ad metrics like ACoS (Advertising Cost of Sale) or ROAS. Factor in marketplace fees, fulfillment costs, and your COGS to understand the true profitability of your campaigns.

Tracing a D2C Google Ads Funnel to Shopify

Now, let's switch gears to a direct-to-consumer (D2C) scenario. You run a Shopify store selling custom-engraved jewelry and use Google Ads to drive traffic. A customer's journey here is often far more complex than a direct click-to-buy on a marketplace.

This is where attribution becomes critical.

Imagine a customer's path looks like this:

- Touchpoint 1: They see one of your Google Shopping ads for a "personalized silver necklace." They click but don't buy.

- Touchpoint 2: A week later, they see a retargeting ad on Instagram (run through your Meta Ads account).

- Touchpoint 3: The next day, they search your brand name on Google, click the organic link, and finally make a $150 purchase.

So, which channel gets the credit? This is the core question of attribution modeling.

- Last-Touch Attribution: Google Organic gets 100% of the credit. This model is simple but often misleading, as it completely ignores the marketing that built awareness and interest earlier on.

- First-Touch Attribution: The initial Google Shopping ad gets 100% of the credit. This is useful for understanding which channels are best at generating initial discovery.

- Linear Attribution: Each of the three touchpoints (Google Shopping, Instagram, Google Organic) gets equal credit—$50 in revenue is attributed to each.

For a D2C brand, a multi-touch attribution model (like linear or time-decay) almost always provides a more accurate view of how your channels work together. Relying solely on last-touch will cause you to undervalue your top-of-funnel efforts, like that initial Google Shopping ad. You might end up cutting the budget from the very channels that introduce new customers to your brand. Making sense of this data is a key pillar of effective data-driven marketing strategies.

D2C brands also have other "hidden" marketing costs beyond ad spend, like subscriptions for CRO tools, heatmaps, or email marketing platforms. These should always be factored into your overall channel ROI calculations to get the full picture. For a detailed look at measuring the effectiveness of your customer retention efforts, explore how to calculate the ROI of your loyalty and retention initiatives.

Thinking Long-Term With CLV and Payback Periods

Winning in ecommerce means playing the long game. While single-campaign ROI gives you a snapshot, the brands that truly scale focus on sustainable, long-term health. This is where you shift from chasing one-off transactions to building profitable customer relationships over time.

This is where Customer Lifetime Value (CLV) becomes one of your most powerful metrics. It’s the total profit your business can expect to make from a single customer throughout their entire relationship with your brand. Once you understand CLV, you can justify higher upfront acquisition costs, knowing the long-term payoff is worth it.

This long-term perspective is the secret to scaling profitably. Focusing on CLV helps you spot your most valuable customer segments, so you can tailor your marketing to attract more people just like them. Our guide on how to scale an ecommerce business dives deeper into using metrics like this to fuel sustainable growth.

Calculating and Applying CLV in Your ROI

So, how do you actually plug this forward-looking metric into your ROI calculations? The CLV ROI formula helps you understand the future value generated by today’s marketing spend. It’s a perfect fit for D2C and marketplace brands focused on building a base of repeat buyers.

The formula is: ROI = (CLV × New Customers – Marketing Investment) / Marketing Investment × 100.

One study highlighted that campaigns ignoring CLV can misjudge their true ROI by as much as 200%. That’s because the initial acquisition costs might look steep, but the long-term profit from repeat purchases gets completely overlooked. You can find more insights on why CLV-focused brands grow faster over at Sprinklr.

Practical Example: Justifying a High-Cost Acquisition Campaign

Imagine your D2C supplement brand is considering a $15,000 influencer marketing campaign. Your data shows that your average customer has a CLV of $350. The campaign is projected to bring in 100 new customers.

- Total Lifetime Value Generated: $350 (CLV) × 100 (New Customers) = $35,000

- CLV ROI Calculation: (($35,000 – $15,000) / $15,000) × 100 = 133%

A simple, short-term ROI might have shown this campaign as barely profitable or even at a loss. But with a CLV-focused lens, you see a healthy 133% return, making the investment a clear long-term win.

Understanding Your Payback Period

While CLV shows you the long-term potential, you still have to manage your cash flow right now. This is where the Payback Period comes in. This metric tells you exactly how long it takes to earn back your initial customer acquisition cost (CAC).

Knowing your payback period is vital for managing cash flow, especially for growing businesses that need to reinvest capital quickly. A shorter payback period means you get your money back faster, letting you pour it back into acquiring the next wave of customers.

- A fast-growing D2C brand with a 3-month payback period can scale marketing spend much more aggressively than a competitor with a 12-month payback period.

- For marketplace sellers on platforms like Amazon, a quick payback period on ad spend is essential for maintaining momentum and staying competitive.

Let’s go back to the supplement brand example. If the $15,000 campaign brought in 100 customers, your CAC is $150 per customer. If your average customer generates $50 in profit per month, your payback period is three months ($150 / $50).

After that three-month mark, every subsequent purchase from that customer cohort becomes pure profit, contributing directly to your bottom line. Balancing a high CLV with a manageable payback period is the key to sustainable, cash-flow-positive growth.

Choosing the right metric depends entirely on the conversation you're having. Are you reviewing last month's performance with your marketing team, or are you in the boardroom planning next year's budget? Knowing when to use standard ROI versus a CLV-based approach makes your data much more powerful.

Short-Term vs. Long-Term ROI Metrics

| Metric | Best Used For | Time Horizon | Strategic Goal |

|---|---|---|---|

| Standard ROI | Evaluating specific campaigns, channels, or ad sets | Short-term (days, weeks, months) | Optimize immediate performance and ad spend efficiency |

| CLV-Based ROI | Assessing long-term channel health and acquisition strategy | Long-term (months, years) | Justify higher acquisition costs and build a sustainable customer base |

| Payback Period | Managing cash flow and determining scaling velocity | Short- to mid-term (weeks, months) | Ensure marketing investments are recouped quickly to fuel further growth |

Ultimately, you need both. Short-term metrics keep your campaigns sharp and efficient, while long-term metrics ensure you're building a business that will last.

Common ROI Calculation Mistakes to Avoid

Knowing the formulas for calculating marketing ROI is only half the battle. The real test is applying them correctly, and unfortunately, a few common pitfalls can completely throw off your results, leading to bad data and even worse strategic decisions.

Think of this as your troubleshooting guide. Even a small error can inflate your numbers, making a losing campaign look like a winner. Let's walk through the most frequent mistakes ecommerce brands make and, more importantly, how to fix them.

Forgetting Hidden and Associated Costs

One of the easiest ways to get your ROI wrong is by only factoring in direct ad spend. But your true marketing cost is so much more than just the clicks. It’s easy to forget the monthly subscription for your email platform, the one-time fee for a graphic designer, or the commission paid to an influencer.

These "hidden" expenses add up fast and can crush your real ROI. Overlooking them gives you an artificially high return that doesn't reflect your actual profitability.

Here's How to Fix It

Create a comprehensive cost checklist for every single campaign. This should include all potential expenses beyond what you pay the ad platform.

- Software Subscriptions (email marketing tools, analytics, CRO software)

- Creative Production (photography, video editing, graphic design)

- Agency or Freelancer Fees (consultants, copywriters, campaign managers)

- Staff Time (if you can allocate a portion of salaries to specific projects)

By tracking every single dollar, you get a true, unvarnished look at your investment. This discipline is critical for accurate calculations and can also improve your on-site performance; our guide on conversion rate optimization tips shows how small, tracked changes can lead to big wins.

Ignoring Returns and Refunds

Another major oversight is calculating ROI based on gross revenue without ever touching returns and refunds. A campaign might generate $10,000 in initial sales, but if 15% of those orders are sent back, your actual revenue is only $8,500.

If you ignore this, you're basing decisions on money you never actually kept. This is especially dangerous in industries with high return rates, like apparel or electronics.

Here's How to Fix It

Always, always calculate ROI using net revenue, not gross sales. The best practice is to wait until the return window has closed for a specific campaign cohort before finalizing your numbers. For ongoing campaigns, you can apply your historical return rate (say, an average of 12%) to your sales figures for a more realistic, real-time estimate.

Misattributing Sales Across Channels

Relying solely on last-touch attribution is a classic mistake. It gives 100% of the credit to the final click before a purchase, completely ignoring all the previous touchpoints—like that first social media ad or a blog post—that introduced the customer to your brand in the first place.

This flawed view can lead you to cut funding for top-of-funnel channels that are essential for building awareness and filling your pipeline, just because they don't drive the final click.

Here's How to Fix It

Adopt a multi-touch attribution model that gives credit to various touchpoints in the customer journey. Models like Linear (equal credit to all touches) or Time-Decay (more credit to recent touches) provide a more balanced and accurate view of how your marketing channels actually work together to drive conversions.

Answering Your Lingering Questions About Marketing ROI

Even with the right formulas, real-world questions always pop up once you start digging into the data for your own business. Let's tackle some of the most common ones to clear up any lingering confusion so you can calculate your marketing ROI with confidence.

Think of this as a final gut-check. We'll cover what a "good" return actually looks like and how to think about campaigns that don't drive immediate, obvious sales.

What Is a Good Marketing ROI for Ecommerce?

There’s no single magic number here—a "good" ROI really depends on your industry, profit margins, and overall business model. That said, a common benchmark many ecommerce brands shoot for is a 5:1 ratio, which is just a 500% ROI. For every $1 you spend, you get $5 back in revenue.

Why that number? It usually provides a healthy enough buffer to cover your cost of goods sold (COGS), shipping, and other overhead while still leaving a solid chunk of profit.

- A 2:1 (200%) ROI is often hovering around the break-even point. You're probably covering your costs, but you aren't generating much actual profit.

- A 10:1 (1000%) ROI is exceptional. This is the kind of return you see with high-margin products or incredibly dialed-in campaigns.

Ultimately, your target ROI has to be tied to your specific profit margins. A brand with a juicy 70% gross margin can do just fine on a lower ROI than a brand squeaking by with a 30% margin.

The most important thing is to be profitable. Calculate your break-even ROAS (Return on Ad Spend) by dividing 1 by your profit margin. If your profit margin is 25%, your break-even ROAS is 4 (or 400% ROI). Anything you make above that is pure profit.

How Do You Calculate ROI for Brand Awareness Campaigns?

This is a great question because it gets to the heart of a common marketing challenge. How do you measure the value of campaigns that aren't designed for a direct sale, like brand awareness efforts or top-of-funnel content?

The short answer is: you have to take a different approach. Since you can't tie these campaigns directly to a purchase, you need to measure their impact using proxy metrics that point toward long-term value.

Instead of a direct ROI formula, you'll be tracking leading indicators of future success. These metrics prove that your campaign is building an audience and creating brand equity that will absolutely pay off down the road.

Key Metrics to Track:

- Branded Search Volume: Is the number of people typing your brand name into Google going up? That's a huge signal that awareness is growing.

- Website Direct Traffic: Are more users typing your URL straight into their browser? This shows you’re memorable.

- Social Media Engagement: Look at follower growth, share of voice, and engagement rates. These tell you if you're building a real connection with your audience.

- Assisted Conversions: Jump into your analytics platform. How often did these top-of-funnel campaigns act as an early touchpoint in a customer journey that eventually led to a sale?

By keeping an eye on these trends, you can easily demonstrate the value of your brand-building efforts, even without a clean, immediate ROI figure to show for it.

At Next Point Digital, we transform complex data into clear, actionable growth strategies. If you're ready to move beyond guesswork and start making decisions that scale your ecommerce business profitably, we can help. Schedule a consultation with us today and let's build your roadmap to success.