Think of the most searched terms on Amazon as more than just words. They're a direct line into the minds of millions of shoppers, revealing their needs, wants, and problems in real-time. Getting a handle on this data is the critical first step to success on the platform, giving you a clear roadmap to line up your products with what people are already looking for.

Cracking the Code of Amazon Consumer Demand

Imagine having a direct line into the minds of millions of shoppers. That’s the real power hidden inside Amazon’s search bar. It isn't just a simple tool for finding things; it’s a live, unfiltered feed of what customers actually want. Every single query typed into that box is a problem waiting for a solution—and that solution could be your product.

Understanding the most searched terms on Amazon is the bedrock of any solid sales strategy. When you know the exact words customers are using, you can position your product as the perfect answer. This completely flips the script from guessing what people want to confidently meeting existing demand.

Aligning Strategy with Search Data

High-volume keywords are your roadmap to building a growth plan that perfectly matches what customers are already trying to buy. By focusing on these terms, you make sure your efforts are aimed at an audience that's ready to listen. That's a huge piece of the puzzle when you're learning https://npoint.digital/how-to-scale-an-ecommerce-business/.

This data-first approach lets you:

- Anticipate Market Needs: Spot rising trends before your competitors do.

- Optimize Product Visibility: Get your listings in front of the most relevant shoppers.

- Improve Conversion Rates: Speak your customer's language, which builds trust and leads to more sales.

- Inform Product Development: Find gaps in the market based on searches that aren't being met.

In essence, every popular search term tells a story about what a specific group of shoppers is looking for. By analyzing these stories, sellers can craft more compelling product titles, descriptions, and advertising campaigns that resonate deeply with their target audience.

For sellers who want to keep a constant pulse on the market, you can explore current trends and strategies related to Amazon search to stay ahead of the curve. Getting these core concepts right transforms your approach from reactive to proactive, paving the way for sustainable growth.

To help you get started, the table below breaks down the different types of search terms and their strategic value.

A Strategic Guide to Amazon Search Term Types

This table breaks down the most common high-volume search term categories, explaining their strategic use cases for Amazon sellers and their impact on different marketing goals.

| Search Term Type | Description & Example | Strategic Application | Key Metric to Track |

|---|---|---|---|

| Broad Keywords | General terms covering a wide category. Example: "running shoes" | Target top-of-funnel shoppers to build brand awareness and drive initial traffic. | Impressions, Click-Through Rate (CTR) |

| Long-Tail Keywords | Highly specific, multi-word phrases. Example: "lightweight running shoes for flat feet" | Attract high-intent buyers ready to purchase, leading to better conversion rates. | Conversion Rate, Cost-Per-Acquisition (CPA) |

| Branded Keywords | Terms that include a specific brand name. Example: "Nike running shoes" | Capture demand from shoppers who already know and trust a brand. Also useful for competitor targeting. | Ad Spend on Branded Terms, Share of Voice |

| Seasonal Keywords | Terms that spike in popularity during specific times. Example: "waterproof boots for winter" | Capitalize on seasonal demand by timing your marketing campaigns and inventory. | Search Volume Trends, Sales Velocity |

| Problem/Solution Keywords | Phrases describing a problem the shopper has. Example: "shoes for plantar fasciitis" | Position your product as the ideal solution to a specific pain point. | Customer Reviews Mentioning the Problem, Click-Through Rate (CTR) |

Understanding these keyword types is the first step toward building a smarter, more effective Amazon strategy that's driven by real customer behavior, not just guesswork.

How Amazon Search Volume Reveals Buyer Intent

Think of Amazon as a massive digital mall. Search volume is your foot traffic. High-volume, broad keywords like “shoes” are the main hallways, packed with shoppers who are just starting to look around. They have a rough idea of what they need, but they’re not ready to buy just yet.

Now, consider a super-specific search like “women's waterproof hiking boots size 8.” That’s a shopper marching straight to a specific store. They aren't browsing anymore—they're on a mission. The search volume is way lower, but the buyer intent is through the roof. Getting this distinction right is the first step to truly understanding the data behind the most searched terms on Amazon.

Raw search volume alone doesn't tell the whole story. A keyword with 100,000 monthly searches might seem like a goldmine, but if it never leads to sales, it’s just empty traffic. On the flip side, a keyword with only 500 searches could be incredibly profitable if it perfectly matches your product and attracts customers with their credit cards out.

Decoding the Intent Behind the Search

The words customers type are breadcrumbs leading back to where they are in their buying journey. We can usually sort these searches into a few key buckets, each signaling a different level of intent. Learning to spot these patterns is a cornerstone of building successful data-driven marketing strategies.

Here’s how to break down the different levels of intent:

- Informational Intent: These people are in research mode. They’re searching for things like “best espresso machines under $200” or “how to choose a yoga mat.” They want answers, not necessarily to buy right now.

- Navigational Intent: This is when a shopper knows what brand or product they want. A search for “Nespresso Vertuo pods” shows they’re looking for a specific item on Amazon.

- Transactional Intent: This is where the magic happens. Searches like “buy black running socks” or “eco-friendly dog toy sale” scream “I want to buy something now.” These are your highest-converting keywords, hands down.

By looking at the language of a search query, you can make an educated guess about a shopper's mindset. This insight lets you tailor your product listings and ad campaigns to meet them exactly where they are.

The Influence of Seasonality and Trends

Buyer intent isn't set in stone. It shifts with seasons, holidays, and whatever is trending at the moment. The search volume for “christmas lights” goes wild in November, just as “pool floats” blows up in late spring. These predictable cycles are gold for planning your inventory and marketing.

But it’s not just about the big seasons. Micro-trends can pop up out of nowhere. A single viral TikTok video can make a random kitchen gadget the most sought-after item overnight. If you’re not watching for these spikes, you’re leaving money on the table.

Here's a simple way to stay on top of these changes:

- Monitor predictable seasons: Build your keyword strategy around major holidays and seasons that fit your products (e.g., “back to school supplies,” “valentine's day gifts for him”).

- Watch for sudden spikes: Use keyword tools to set up alerts for terms related to your niche. This helps you catch new trends as they’re taking off.

- Analyze competitor data: Keep an eye on the keywords your top competitors are ranking for. It’s a great way to spot demand shifts you might have otherwise missed.

Ultimately, search volume is far more than a popularity contest. It’s a direct window into your customers' minds—their problems, their desires, and their readiness to buy. When you learn to look past the raw numbers and read the intent behind the search, you can turn data into a predictable engine for growth.

Uncovering Top Amazon Keywords with the Right Tools

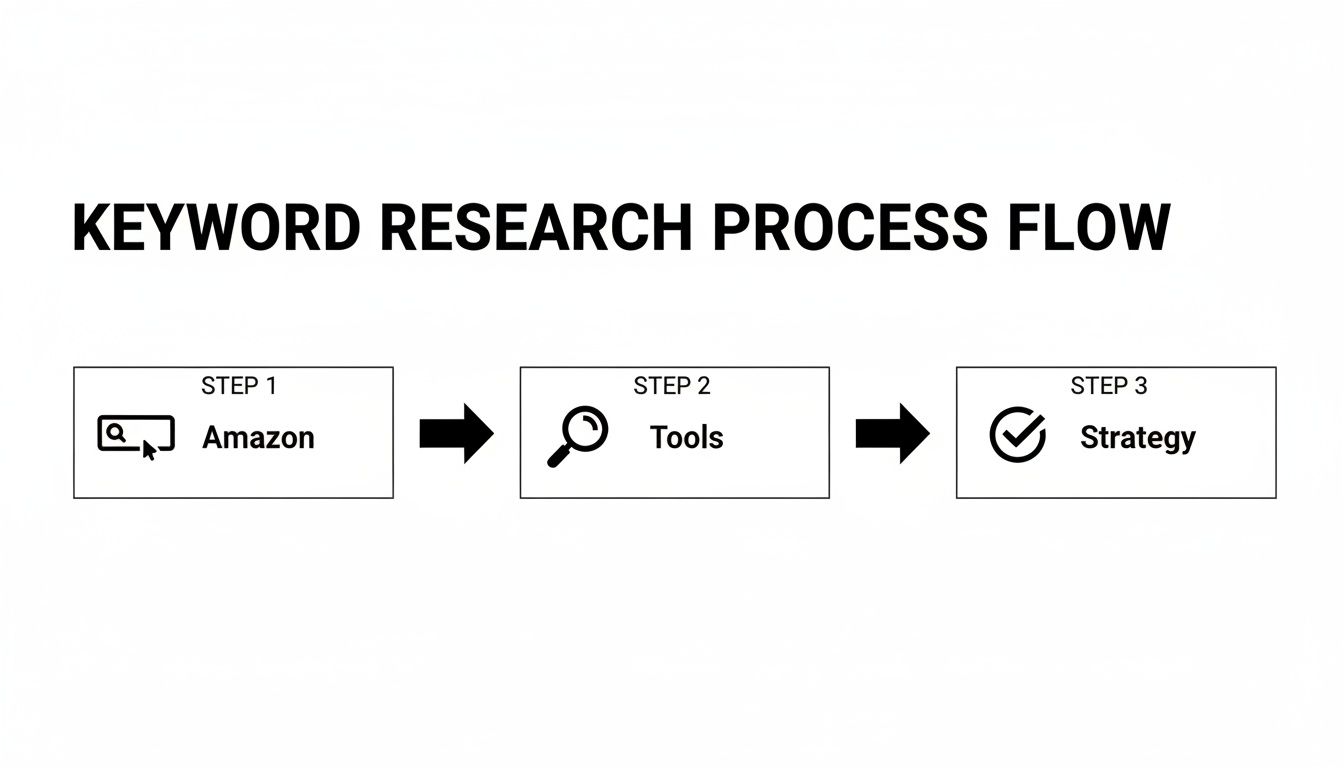

Alright, let's move from theory to action. The next step is figuring out the exact, high-demand keywords that are going to fuel your growth on Amazon. Finding the most searched terms isn't a guessing game; it's about using a smart, hybrid approach.

This means you need to blend Amazon's own powerful, built-in resources with specialized third-party software. Tapping into both gives you the complete picture of what your customers are actually searching for. It’s like getting a top-down and bottom-up view of the market all at once. For a deeper dive into the core principles, this guide on conducting effective keyword research is a great resource that applies to any search engine, including the beast that is Amazon.

Starting with Amazon’s Native Resources

Before you spend a single dollar, you need to milk Amazon's own platform for all the free clues it offers. The simplest tool is staring you right in the face: the search bar.

As you start typing, Amazon's autocomplete feature, which they call Search Suggest, instantly drops down a list of popular, related searches. This is a live, real-time look at what actual shoppers are typing into that bar. Think of it as Amazon whispering its most popular search terms directly into your ear.

For example, if you type "coffee maker," you might see suggestions like "coffee maker with grinder," "coffee maker single serve," and "coffee maker for office." Boom. Right there, you've uncovered specific customer needs and potentially lucrative sub-niches you might have missed.

If you’re enrolled in Amazon Brand Registry, the Brand Analytics dashboard is an absolute game-changer. It gives you access to the "Top Search Terms" report, which literally shows you the most popular search terms for a given time period, their search frequency rank, and the top three products shoppers clicked on after searching. This data is pure gold for understanding your niche and identifying who your real competitors are.

Leveraging Third-Party Keyword Tools

Amazon's native resources are great for spotting trends, but third-party tools give you the hard numbers you need to build a real strategy. These platforms estimate monthly search volumes, analyze keyword difficulty, and track trends over time, giving you a much clearer view of whether a term is commercially viable.

These tools help answer the mission-critical questions:

- How many people are actually searching for this term each month?

- Is this keyword's popularity growing, shrinking, or just flat?

- How hard is it going to be to actually rank organically for this?

- Which of my competitors are already owning this keyword?

For example, seeing the scale of some searches can be an eye-opener. Laptops absolutely dominate as the most searched term on Amazon, reflecting the constant demand for portable computers. Data shows 'laptop' even outpaces 'iPhone' and 'Kindle' as the top-searched product. Globally, 'laptop' pulls in massive monthly searches, with variations like 'gaming laptop' alone hitting 12,500 monthly searches and driving an average of 3,200 units sold per month. You can discover more insights about these product trends on meetglimpse.com.

This is where the industry's heavy hitters come in. Platforms like Helium 10, Jungle Scout, and AMZScout are built from the ground up to help you unearth and validate these kinds of opportunities.

Just look at the screenshot below from Jungle Scout's Keyword Scout tool. It shows exactly how it breaks down key metrics for a term like "yoga mat," including monthly search volume, seasonal trends, and even recommended PPC bids.

This kind of visual data doesn't just confirm demand for your main keyword. It also shines a light on profitable long-tail variations like "extra thick yoga mat" that might have less competition and much better conversion rates.

A successful keyword strategy relies on a repeatable workflow. Start by generating a broad list of potential keywords from Amazon's search bar and Brand Analytics, then use a third-party tool to validate their search volume, assess the competition, and prioritize the terms with the best balance of demand and achievability.

To help you choose the right software for your business, here’s a quick breakdown of the top contenders.

A Comparative Look at Amazon Keyword Research Tools

Choosing the right keyword tool can feel overwhelming, but they each have their strengths. This table compares the top-tier platforms to help you decide which one best fits your specific needs, from data accuracy to spying on your competitors.

| Tool | Key Feature for Keyword Research | Best For | Data Reliability |

|---|---|---|---|

| Helium 10 | Cerebro (Reverse ASIN Tool): Lets you see exactly which keywords a competitor's product is ranking for, both organically and through ads. | In-depth competitor analysis and finding hidden keyword opportunities your rivals are using successfully. | High. Uses a sophisticated algorithm to model search volume and sales data. |

| Jungle Scout | Keyword Scout: Provides precise search volume data, historical trends, and an easy-to-understand "relevancy score" for each keyword. | Validating keyword demand with reliable data and understanding seasonal search patterns. | Very High. Known for its data accuracy and extensive database of Amazon products and searches. |

| AMZScout | Keyword Search & Reverse ASIN Lookup: Offers strong keyword discovery features with a clean interface and useful metrics like estimated monthly sales. | Sellers looking for a user-friendly tool that provides a solid balance of keyword research and product validation features. | Good. Provides reliable directional data for identifying high-potential keywords and niches. |

Ultimately, the best tool is the one that gives you the insights you need to make smarter, data-driven decisions. Whether you're just starting out or looking to refine an existing strategy, combining these tools with Amazon's own data will give you a serious edge.

How to Weave Keywords into Your Product Listings

Finding the most searched terms on Amazon is a huge step, but it's only half the battle. True success comes from knowing exactly where to place those keywords to capture Amazon's attention and drive results. Think of your product listing as a strategic blueprint; every section has a specific job, and placing the right terms in the right spots is what turns browsers into buyers.

This isn't about stuffing keywords wherever they fit. It's about creating a seamless, persuasive experience for the shopper while signaling relevance to Amazon’s A9 algorithm. A well-optimized listing speaks both languages fluently.

This simple workflow shows how insights from Amazon's search bar and third-party tools feed directly into your listing strategy.

Successful optimization isn't random. It’s a structured approach that moves from broad discovery to precise application.

Front-Load Your Product Title for Maximum Impact

Your product title is the single most important piece of real estate on your entire listing. It carries the most weight with Amazon's search algorithm and is often the first—and sometimes only—thing a customer reads. Your primary, highest-volume keywords must go here.

A strong title should be clear, descriptive, and packed with value right from the start.

- Start with the Core: Begin with your main keyword that best describes the product.

- Add Key Features: Include critical attributes like size, color, material, or quantity.

- Mention the Brand: Always include your brand name to build recognition.

For instance, a generic title like "Coffee Maker" is weak. A much stronger version would be: "Apex Home Single Serve Coffee Maker for K-Cups – Compact Drip Brewer Machine, Black." This version targets multiple high-intent keywords naturally.

Use Bullet Points to Answer Customer Questions

The bullet points are your opportunity to sell the benefits while weaving in important long-tail keywords. This section should directly address the questions and needs that shoppers are typing into the search bar. Think of each bullet point as a mini-headline designed to highlight a key feature and its benefit.

Instead of just listing features, frame them as solutions. If your research shows people search for "quiet coffee maker," a bullet point could be: Whisper-Quiet Operation: Brew your morning cup without waking up the house.

This approach not only incorporates the keyword but also connects with a customer's specific pain point, making your product far more appealing. For more tips on this, check out our complete guide to optimize Amazon product listings.

Craft a Compelling Product Description

Your product description is where you tell your brand’s story and dive deeper into the product's uses. While it has less SEO weight than the title or bullets, it’s still indexed by Amazon and is crucial for converting shoppers who are on the fence.

Use this space to expand on the benefits you introduced in the bullet points. Weave in secondary and related keywords naturally to create a rich, informative narrative that helps shoppers visualize themselves using your product.

Maximize Your Backend Search Term Fields

The backend search term fields in Seller Central are your secret weapon. These keywords are completely invisible to shoppers but are fully indexed by Amazon’s algorithm. This is the perfect place for terms you couldn't fit into your visible listing copy.

Think of backend keywords as a safety net for your SEO. It's the ideal spot for synonyms, common misspellings, and related terms that would make your title or bullets sound unnatural and cluttered.

For our coffee maker, the backend could include terms like "espresso," "cappuccino machine," "office coffee station," and even misspellings like "coffeemaker." It’s a powerful way to expand your reach without sacrificing readability. Just remember, there's no need to repeat keywords already used in your title or bullet points.

Let’s bring this to life with a real-world example. The term 'coffee' generates over 16,600,000 monthly searches on Amazon, making it a beverage giant. This massive volume drives consistent sales and connects to an entire ecosystem of related searches like 'Stanley thermos mug' (210,000 monthly searches) and 'smart coffee maker,' showcasing how a core term branches out. By strategically placing these related terms throughout your listing, you capture a much wider net of interested shoppers.

Using Keywords to Fuel Your Advertising and A Plus Content

Your keyword strategy isn’t finished once your product listing is optimized. Far from it. The real magic happens when you take what you’ve learned about the most searched terms on Amazon and weave it into every corner of your marketing, especially your ads and A+ Content.

This is how you build a cohesive, data-driven experience that doesn't just attract shoppers but actually convinces them to buy. Think of your keyword research as the blueprint for your entire marketing house. Your listing is the foundation, sure, but your ads and A+ Content are the walls and roof that complete the structure and invite people inside.

Powering Your Amazon PPC Campaigns

That list of high-volume and long-tail keywords you worked so hard to build? It’s the perfect launchpad for creating seriously profitable Sponsored Products campaigns. By organizing these keywords into different ad groups and match types, you can get a solid grip on your spending while simultaneously discovering new ways customers are searching.

This approach lets you be both surgical and exploratory at the same time. You can go after proven, high-converting terms with exact match campaigns, while using broad match to fish for new, emerging phrases you might have otherwise missed. If you want to go deeper on structuring these campaigns, our guide on what PPC is on Amazon offers a great framework to get you started.

Here’s a practical way to set up your campaigns:

- Exact Match Campaigns: This is where you put your top-performing, most relevant keywords. It gives you maximum control and usually delivers the best return on ad spend (RoAS).

- Broad Match Campaigns: Use more general, high-volume terms here to cast a wider net. Think of this as your discovery engine for finding new long-tail keywords, which you can later promote to your exact match campaigns.

- Competitor Targeting Campaigns: Go after your competitors' brand names as keywords. This puts your product right in front of shoppers who are already considering a nearly identical option.

A solid advertising strategy is a constant cycle of discovery and refinement. Use broad campaigns to find out what works, then double down on those winning keywords in more targeted exact match campaigns to squeeze out every drop of profit.

Elevating A+ Content with Keyword Insights

A+ Content (also called Enhanced Brand Content) is your opportunity to answer the questions that are hidden inside customer searches. It lets you use rich visuals, comparison charts, and persuasive text to move beyond basic features and tell a compelling brand story. Your keyword research is what tells you exactly which story to tell.

Every high-volume search term is a window into a customer's needs or questions. Your A+ Content should be designed to answer them, both visually and with text. It's a powerful one-two punch that builds trust and pushes conversions over the finish line.

A Practical Example of an Integrated Strategy

Let's imagine your research reveals that "eco-friendly coffee pods" is a massive keyword in your niche. Here’s how you can thread that single insight across all your marketing efforts:

- Product Listing: You make sure "eco-friendly coffee pods" is featured prominently in your title and bullet points. No hiding it.

- Sponsored Products: You build an exact match ad group targeting "eco-friendly coffee pods" and related phrases like "compostable k-cups."

- A+ Content: You design an entire module that showcases your brand's commitment to sustainability. It could feature:

- An infographic illustrating the lifecycle of your compostable pod.

- Beautiful, high-quality images of your product in natural, earthy settings.

- Text that reinforces your brand’s mission and spells out the environmental benefits.

By aligning every single touchpoint with what the customer originally searched for, you create a completely seamless journey. The shopper looked for a sustainable option, your ad confirmed you had one, and your A+ Content proved it beyond a doubt. This kind of cohesive approach removes all the friction and makes the "add to cart" click feel like a no-brainer.

How to Track and Adapt Your Amazon Keyword Strategy

Amazon is anything but static; it’s a living, breathing marketplace where shopper trends can shift in an instant. This means your keyword strategy can't be a "set it and forget it" project. You have to treat it like an ongoing cycle of testing, tracking, and tweaking to stay visible and keep sales coming in.

Think about it—a keyword that brings in tons of traffic this month could get sidelined by a new trend next month. Staying on top of your keyword performance is the only way to catch these shifts before they hurt your sales. Without this constant feedback loop, even the most brilliant keyword research will eventually go stale.

Key Metrics for Measuring Keyword Success

To figure out if your strategy is actually working, you need to be tracking the right data. Don't get distracted by vanity metrics that look good but don't mean anything. Instead, zero in on the handful of numbers that directly impact your bottom line.

These are the critical metrics you should be watching:

- Organic Rank: Where do you show up in the search results for your most important keywords? If your rank is climbing, your SEO efforts are working. If it suddenly tanks, you might have new competition or an algorithm change on your hands.

- Conversion Rate: Of all the shoppers who find your product using a specific keyword, what percentage actually buys? A high conversion rate is a great sign that your product is exactly what they were looking for.

- Advertising Cost of Sale (ACoS): For your sponsored ads, this tells you how much you're spending to get a single sale. Tracking ACoS for each keyword helps you spot the profitable terms and cut the ones that are just burning through your budget.

Think of these metrics as the dashboard for your keyword strategy. Keeping a close eye on your rank, conversions, and ACoS lets you make decisions based on real data, not guesswork. This approach is fundamental to making sense of your broader Amazon sales data.

Creating a Simple Keyword Audit Framework

One of the best ways to stay ahead is to schedule a simple keyword audit every quarter. This forces you to get rid of keywords that aren't pulling their weight and jump on new opportunities before your competitors even know what's happening.

Here’s a simple three-step framework you can follow:

- Review Performance: Dig into the metrics we just talked about for your main keywords. Look for terms with a sky-high ACoS and a rock-bottom conversion rate—those are the first ones on the chopping block.

- Identify New Opportunities: Fire up your keyword research tools and hunt for emerging trends or seasonal terms that fit your product. There are always new phrases popping up.

- Optimize and Reallocate: Swap out the underperforming keywords with your new, promising ones. Update them in your product listing, backend fields, and PPC campaigns. Then, take the ad budget you were wasting on the losers and put it behind these potential winners.

This proactive cycle keeps your strategy fresh and aligned with what shoppers are actually searching for, turning market insights into a real competitive edge.

Got Questions About Amazon Keywords? We've Got Answers.

Jumping into the world of Amazon keywords always brings up a ton of questions. To make things easier, I've put together some quick, no-fluff answers to the queries we hear most often from sellers trying to master the most searched terms on Amazon.

Think of this as your go-to guide for refining your strategy and making smarter, data-backed decisions.

How Often Should I Update My Keywords?

Keyword research isn't a "set it and forget it" task—it's an ongoing process. You'll want to do a full-blown audit every quarter to keep up with seasonal trends and shifts in how shoppers are searching.

For your top 5-10 money-making keywords, though, a quick monthly check-in is a must. This helps you spot any sudden drops in search volume or a competitor sneaking up the ranks, giving you a chance to react before it hurts your sales.

Think of your keywords like a garden. You can't just plant them and walk away. Regular maintenance—pruning what doesn't work and planting new seeds based on emerging trends—is essential for a healthy harvest.

Are Third-Party Search Volume Estimates Accurate?

Here's the deal: no tool is 100% perfect because Amazon holds its official search data close to the chest. But the leading platforms use pretty sophisticated data modeling to give you estimates that are more than good enough to work with.

The trick is to use this data directionally, not literally.

Focus on comparing the relative popularity between keywords to find your best opportunities. For instance, knowing "eco-friendly coffee pods" gets five times the traffic of "organic coffee pods" is the kind of actionable insight you need, even if the exact search volumes are just solid estimates.

Should My Advertising Keywords Match My SEO Keywords?

They should definitely overlap, but they shouldn't be identical. Your on-page SEO keywords need to be hyper-focused on the most relevant, high-converting terms that will build your long-term organic rank. Your advertising strategy, on the other hand, gives you room to be more aggressive and experimental.

Use your Pay-Per-Click (PPC) campaigns to:

- Bid on competitor brand names and siphon off some of their traffic.

- Test out new long-tail keywords to see if they convert before committing them to your listing.

- Target broader, high-volume phrases that are just too competitive to rank for organically.

The data you get from your ad campaigns is pure gold. It often uncovers high-performing keywords you would have otherwise missed, which you can then feed right back into your organic SEO strategy. It creates a powerful feedback loop that just keeps fueling your growth.

At Next Point Digital, we turn confusing Amazon data into clear, actionable growth plans. If you're tired of guessing and ready to scale with a data-driven approach to your keywords, ads, and listings, we’re here to help you build that roadmap. Learn more at https://npoint.digital.