An effective Amazon pricing strategy isn't just about picking a number; it's a data-driven system built to win the Buy Box and protect your profits in one of the world's most competitive marketplaces. It means moving past simple cost-plus thinking and embracing competitive analysis, demand forecasting, and smart automation.

Why Your Amazon Pricing Strategy Matters More Than Ever

Struggling to keep up with the constant price shifts on Amazon? You're not alone. In this battlefield of a marketplace, a reactive approach to pricing is a guaranteed path to lost sales and shrinking margins. The days of "set it and forget it" are long gone.

Think of Amazon less like a retail store and more like a stock market where millions of variables shift prices every single second. Amazon itself reportedly changes prices millions of times a day. In that kind of environment, manual adjustments are just too slow to compete. To win, you have to be proactive and intelligent.

The New Rules of the Game

On Amazon today, your pricing is one of the most powerful levers you have. It directly impacts your sales velocity, your ability to win the Buy Box, and, of course, your profitability. A well-thought-out strategy isn't just a "nice-to-have"—it's a core business function.

Here’s why you need a formal approach to pricing:

- Buy Box Dominance: A staggering 82% of all Amazon sales happen through the Buy Box. Your pricing strategy is one of the heaviest-weighted factors in the algorithm that decides who gets this critical spot.

- Profit Protection: Competing on price alone is a race to the bottom. A smart strategy finds the sweet spot between staying competitive and protecting your margins, ensuring you’re not just making sales, but profitable sales.

- Algorithmic Favor: Amazon's A9 algorithm loves products with strong sales velocity. Strategic pricing, including well-timed promotions, can give your sales a jolt, which in turn boosts your organic search ranking.

A common myth is that the lowest price always wins. The reality is, Amazon’s algorithm is more like a performance scorecard. It weighs price heavily, but it also factors in fulfillment method, shipping speed, and seller metrics. A slightly higher-priced FBA offer will almost always beat a cheaper FBM offer.

This guide is your roadmap to turning pricing from a guessing game into a powerful growth engine. We'll break down the foundational models every seller should know, from simple cost-plus to more sophisticated value-based strategies. You'll also learn how to use automation and data to stay competitive 24/7.

Mastering these concepts is fundamental to learning how to increase sales on Amazon for the long haul. By the end, you’ll have the framework to build a pricing strategy that drives real growth while protecting your bottom line.

Before you can get fancy with automated repricers and dynamic adjustments, your Amazon pricing strategy needs a solid foundation. Every successful approach starts with one of three core models. Getting this first step right is critical—it sets the tone for every price change, promotion, and competitive move you’ll make down the road.

Think of these models as different blueprints for building a house. Each one gets the job done, but the best choice depends on your product, your brand, and your ultimate goals.

Let's break down the three foundational blueprints for Amazon pricing.

Cost-Plus Pricing: The Straightforward Path

Cost-plus is the simplest and most common starting point, especially for new sellers. The logic is dead simple: figure out your total cost for a product, then add a fixed percentage on top to create your profit margin. It’s like baking a cake—you add up the cost of flour, sugar, and eggs, then tack on a markup for your time and profit.

This model is designed to ensure every sale is profitable, at least on paper. But to pull it off, you have to account for all your costs.

- Cost of Goods Sold (COGS): What you paid your supplier for the product itself.

- Shipping & Freight: The cost to get your inventory from the factory to an Amazon warehouse.

- Amazon Fees: This is a big one. It includes referral fees, FBA fulfillment fees, and monthly storage costs.

- Overhead: A slice of your business's fixed costs, like software subscriptions or marketing expenses.

Once you have your total cost per unit, you just apply your desired margin. For instance, if your all-in cost for a product is $12.50 and you want a 40% margin, you’d price your product at $20.83. It’s easy, but be warned: this model can leave a lot of money on the table if customers are actually willing to pay more.

Competition-Based Pricing: The Strategic Chess Match

Competition-based pricing flips the script, shifting your focus from internal costs to the external market. With this strategy, you set your prices mainly in relation to what your direct competitors are charging. This isn’t about just copying them; it’s a strategic chess match where your moves are dictated by your opponents'.

This model is non-negotiable for resellers or anyone selling on an ASIN with multiple other offers. Your goal isn’t always to be the cheapest, but to be positioned perfectly against the other sellers, especially the one currently holding the Buy Box.

The real art of competition-based pricing isn’t just matching or undercutting. It’s about understanding your position. If you offer FBA Prime shipping and your main competitor is a slower FBM seller, you can often price 5-10% higher and still win the sale because you’re offering more convenience.

This approach demands constant vigilance. Automated repricing tools are practically a requirement here. They can adjust your price within limits you define based on what your competitors do, keeping you in the game 24/7 without you having to stare at a screen all day.

Value-Based Pricing: The Brand Builder's Choice

Value-based pricing is the most sophisticated and, when done right, the most profitable model. Forget your costs and ignore your competitors for a moment. Instead, you price your product based on the perceived value it delivers to the customer. This is the go-to strategy for private-label brands, unique inventions, or any item with a powerful brand story.

Think about premium brands like Apple or Yeti. They don’t price their products based on the cost of the components or what Samsung is charging. They price based on the value their brand, design, and user experience provide. Customers are paying for the quality, innovation, and status that come with the logo. For a deeper look at this, our guide on how to determine the price of a product offers a complete framework.

To succeed with value-based pricing, you absolutely must have a superior product backed by:

- Strong Branding: Professional packaging and a compelling brand story that connects with people.

- Excellent Social Proof: A mountain of glowing reviews and testimonials.

- Superior Quality: A product that is demonstrably better than the alternatives.

- A+ Content: Rich, engaging product detail pages that scream value and solve your customer’s problem.

This model opens the door to the highest margins, but it requires a serious investment in brand building and marketing to convince shoppers that your product is worth the premium.

Comparing Foundational Amazon Pricing Models

Choosing the right foundational model sets the trajectory for your entire pricing strategy. This table breaks down the core principles, ideal use cases, and inherent risks of each approach to help you decide on the best starting point for your products.

| Strategy | Core Principle | Best For | Primary Risk |

|---|---|---|---|

| Cost-Plus | Price = Total Costs + Target Margin | New sellers, products with stable costs, straightforward inventory | Leaving money on the table; ignoring market demand and perceived value. |

| Competition-Based | Price is set relative to competitors' prices | Resellers, crowded markets, products with many direct substitutes | Price wars that erode margins; becoming reactive instead of strategic. |

| Value-Based | Price is based on the customer's perceived value | Private label brands, unique products, items with strong brand equity | Requires significant investment in branding and marketing to justify the premium. |

Each model has its place. A new reseller might start with competition-based pricing to win the Buy Box, while a brand launching an innovative new gadget would lean heavily on a value-based approach from day one. The key is to match the model to your specific situation.

Using Dynamic Pricing and Automation to Compete 24/7

While the pricing models we've covered give you a solid foundation, the Amazon marketplace moves way too fast for any static price to stay effective for long. If you really want to compete, you have to embrace dynamic pricing—the art of adjusting your prices in real-time as the market shifts. This is where automation stops being a luxury and becomes an absolute necessity.

Automated repricing tools are the engine that powers modern Amazon selling. Forget the old myth about them being a simple "race to the bottom." Today's sophisticated software acts like your most diligent employee, making thousands of smart pricing decisions around the clock. It's a job no human could ever keep up with manually.

Think of it as putting your pricing strategy on autopilot. Instead of obsessively checking what your competitors are doing, you set the strategic flight plan. The software then makes constant micro-adjustments based on a live stream of data, making sure you're always in the best position to win the sale.

How Repricers Actually Work

At their core, repricing tools run on a set of rules you create. These rules are triggered by specific events on Amazon, allowing for instant, strategic reactions. You're not just telling the tool to "beat the lowest price"; you're giving it a sophisticated decision-making framework to follow.

Here are a few key triggers a repricer can act on:

- Competitor Price Changes: Instantly match a key competitor or, even better, position your price just slightly above or below them.

- Buy Box Ownership: The moment you lose the Buy Box, the repricer can automatically adjust your price to help win it back.

- Inventory Levels: When a competitor's stock runs low or they sell out, your tool can raise your price to capitalize on the dip in competition.

- Sales Velocity: You can program it to lower prices slightly during slow periods to kickstart demand or raise them during peak shopping times.

The single most important rule you will ever set is your floor price. This is your non-negotiable minimum price to sell a product while still turning a profit. Without a hard floor, automation can quickly chew through your margins in a price war.

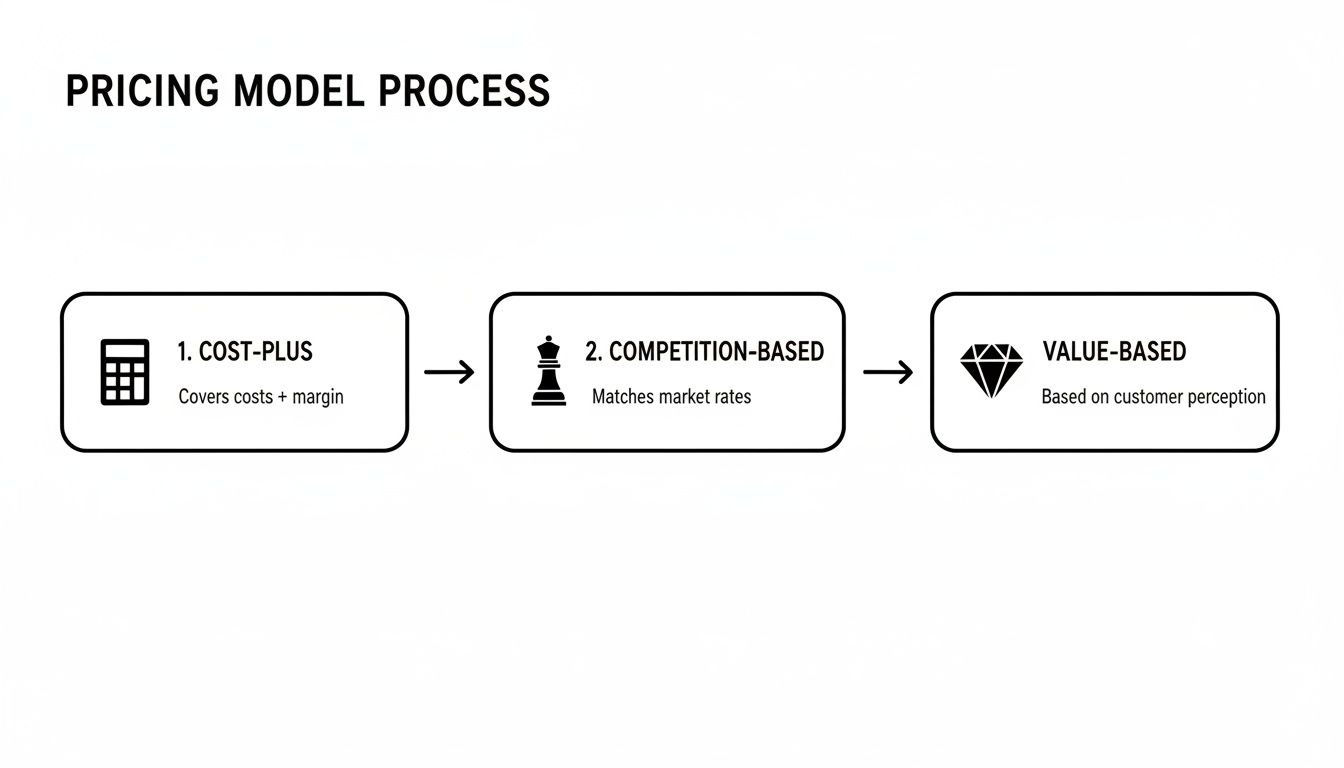

The flowchart below shows how these different pricing models build on each other, moving from simple internal calculations to complex, market-driven strategies.

This visual really highlights the journey from cost-based decisions to the external, market-focused strategies where automation truly shines.

Leveraging Real-Time Data for a Competitive Edge

Let's be clear: Amazon itself is the master of dynamic pricing. Its own algorithms reportedly adjust prices as often as every 10 minutes, crunching over 2.5 million variables for every single decision. They look at everything from competitor prices and demand to inventory levels and even the time of day.

Your automation strategy should aim to mimic this data-driven mindset, just on a smaller scale. A good repricer doesn't just stare at competitor prices; it pulls in multiple data points to make the smartest move. This is where solid data analysis becomes your secret weapon, a concept we dig into much deeper in our guide to https://npoint.digital/data-driven-marketing-strategies/.

To compete 24/7, you need the right intel. Using the best competitor price tracking software is non-negotiable. This is what feeds your automated rules, turning raw market data into profitable actions.

By setting up smart automation, you shift from being a reactive seller to a proactive one. You can program your system to not only lower prices to win sales but also to raise them, grabbing opportunities for higher profits the second they pop up. This strategic use of technology is how you scale your Amazon business without sacrificing your margins.

How to Win the Buy Box Without Tanking Your Profits

One of the biggest myths on Amazon is that the lowest price always wins the Buy Box. It’s a dangerous assumption that has dragged countless sellers into brutal price wars that absolutely demolish their profit margins.

The truth is a lot more complex. Amazon’s algorithm isn’t just looking for the cheapest product; it’s hunting for the seller who can deliver the best overall customer experience.

Winning the Buy Box is less about a race to the bottom and more about proving you’re a top performer. While your landed price (your item price plus shipping) is a huge piece of the puzzle, it’s just one factor. Amazon’s algorithm weighs a handful of variables to predict which seller is most likely to make a customer happy. That seller often gets the Buy Box, even if their price is higher.

The Key Pillars of Earning the Buy Box

Think of your seller account as having a hidden "Buy Box score." A higher score proves you're a trusted seller, which gives you the leverage to compete without having to offer a rock-bottom price. Nailing these key areas is your ticket to winning the Buy Box while protecting your margins.

Your fulfillment method is, without a doubt, the most important factor after price. Sellers who use Fulfillment by Amazon (FBA) have a massive leg up because Amazon can guarantee the Prime shipping speeds and service quality that customers love.

An FBA seller can often price their product 3-5% higher than a Fulfillment by Merchant (FBM) seller and still keep the Buy Box. Amazon’s algorithm trusts the reliability and speed of its own logistics network above all else.

Beyond fulfillment, your account health is always under the microscope. Amazon tracks just about everything to make sure buyers are getting a smooth, predictable experience. The big metrics include:

- Seller Feedback Rating: Keep this high—ideally 98% or better. It’s a direct signal to Amazon that customers trust you.

- Order Defect Rate (ODR): This has to stay under 1%. It’s a blend of negative feedback, A-to-z claims, and credit card chargebacks.

- Shipping Performance: For FBM sellers, this is make-or-break. Your late shipment rate and valid tracking rate need to be nearly perfect.

- Inventory Health: If you’re constantly running out of stock, you can lose your Buy Box eligibility for that listing. Amazon wants to promote sellers who can keep up with demand.

A Real-World Example of Smart Pricing

Let's look at a common scenario. Two sellers are competing on the same listing for a $25 item.

- Seller A (FBM): Prices the item at $24.50. Their shipping takes 3-5 days, and they have a 95% feedback rating.

- Seller B (FBA): Prices it at $25.50. They offer free 2-day Prime shipping and have a 99% feedback rating.

Nine times out of ten, Seller B will win the Buy Box. The slightly higher price is a small trade-off for the massive value of Prime shipping and a stellar seller reputation. This is the heart of a winning Amazon pricing strategy: build an operational advantage so you can compete on more than just price. You can find a complete breakdown of how Amazon FBA works and its benefits in our detailed guide.

This whole system is really just a reflection of Amazon's own obsession with its market position. The company uses sophisticated algorithms to monitor competitor prices across the web, ensuring it maintains its reputation for low prices. These models might keep its own prices within 5% of a floor when rivals get aggressive, or raise them by 10-15% the moment a competitor goes out of stock. It's a masterclass in blending price with market conditions.

Once you've got your core pricing model humming along and a repricer is handling the daily skirmishes, it's time to get a little more sophisticated. Think of it as moving beyond basic defense and starting to play offense. These are the strategies that don't just react to the market but actively shape it in your favor.

If your pricing foundation is the engine of your car, these advanced tactics are the turbocharger and high-performance tires. They take the power you already have and apply it with more precision to really pull ahead of the pack. We'll zero in on three of the most effective methods: promotions, bundling, and MAP policy enforcement.

Driving Velocity with Promotional Pricing

On Amazon, promotions aren't just for clearing out last season's inventory. When you use them the right way, they're a direct line to influencing the A9 algorithm. A well-timed coupon or Lightning Deal can kick your sales velocity into high gear, which Amazon's algorithm sees as a massive signal of a product's popularity. The result? A higher organic search rank that keeps paying you back long after the promotion ends.

The trick is to use promotions as a short-term catalyst, not a long-term crutch. If you're constantly running deep discounts, you'll just devalue your brand and teach customers to wait for a sale. Instead, treat them like targeted investments to achieve a specific goal.

- Coupons for Conversion: You'd be amazed what a small 5-10% coupon can do for your conversion rate. That little green badge is an eye-magnet for shoppers, creating a sense of urgency and value that often works better than a simple price drop of the same amount.

- Lightning Deals for Rank: These quick, intense promotions are perfect for launching a new product or giving a slow-mover a serious jolt. The goal isn't always about making a huge profit during the deal itself. It's about generating a big enough sales spike to boost your product's visibility for weeks to come.

A common mistake is judging a promotion only by its immediate P&L. A successful Lightning Deal might just break even, but if it leads to a sustained lift in your organic rank, you'll make far more in full-price sales over the next month.

Creating a Moat with Product Bundling

Sick of fighting with ten other sellers over the same Buy Box? The best way to win a price war is to leave the battlefield altogether. Product bundling lets you create a brand-new, unique ASIN that you have 100% control over.

By packaging complementary items together, you create an offer that your competitors can't just jump on. Instead of just selling a yoga mat, you could create a "Yoga Starter Kit" with the mat, a block, and a strap. Suddenly, you have a unique offer with no direct competition, giving you complete control over the price and the Buy Box.

This move shifts the conversation from price to value and convenience. You're no longer just another seller of a commodity; you're offering a complete solution. This not only bumps up your average order value but also builds a defensible position that's much harder for competitors to attack.

Protecting Your Brand with MAP Policies

For brands selling through multiple channels—including your own website—keeping your pricing consistent is non-negotiable. This is where a Minimum Advertised Price (MAP) policy comes in. It’s a formal agreement between you (the brand) and your retailers that they won't advertise your products below a certain price.

While Amazon itself won't enforce your MAP policy, you certainly can. A solid MAP policy stops rogue resellers from starting a race to the bottom that devalues your product everywhere. It ensures customers see a consistent, fair price no matter where they shop, which is critical for protecting your brand’s premium perception.

Putting a MAP policy in place and making it stick takes diligence.

- Establish a Clear Policy: Get it in writing. Draft a formal document that lays out the MAP price for every SKU and spells out the consequences for violations.

- Monitor the Marketplace: Keep an eye out. Use software or manual spot-checks to find sellers advertising below your set MAP price.

- Enforce Consistently: When you find a violator, follow your own rules. This usually starts with a warning and can escalate to cutting off their supply of your product.

Think of a strong MAP strategy as a defensive cornerstone for your entire pricing plan. It stabilizes your product's value, protects the margins of your legitimate retail partners, and preserves the brand equity you've worked so hard to build.

Making Data-Driven Pricing Decisions

Effective pricing on Amazon isn't about gut feelings or what feels right. It’s about cold, hard data. Shifting from guesswork to a scientific approach is what separates stagnant sellers from those who actually build sustainable growth.

It all starts by treating every pricing decision as a testable hypothesis, backed by numbers.

The core of this philosophy is true data-driven decision making. This means you stop guessing and start using your own analytics to make smarter, more profitable choices that protect your bottom line with every automated rule and promotion you run.

Master Your Breakeven Point

Before you can even think about profit, you have to know your costs—down to the penny. A breakeven analysis isn't just a good idea; it's the foundational calculation for every single product in your catalog.

This is the absolute rock-bottom price you can sell an item for without losing money.

To get this number, you have to account for every single expense:

- Cost of Goods Sold (COGS): What you paid your supplier for the product.

- Amazon Fees: Don't forget referral fees, FBA fulfillment, and storage costs.

- Shipping & Inbound Costs: The money it takes just to get your inventory to an Amazon warehouse.

- PPC Ad Spend: Your estimated advertising cost per unit sold.

Once you have this number, it becomes your guardrail. Every pricing rule, discount, and automated adjustment must respect this floor. This ensures that even your most aggressive strategies remain profitable. To get a better handle on this, you can learn more about analyzing your Amazon sales data.

A/B Testing Your Prices for Maximum Profit

One of the most powerful tools in your data toolkit is A/B testing, also known as split testing. It’s a straightforward experiment where you pit different price points against each other to see how customers respond.

The goal isn't just to sell more units; it's to find the perfect balance between conversion rate and profit margin.

The process is simple but requires patience. You set a price for a fixed period—say, two weeks—and measure your key metrics. Then, you adjust the price slightly up or down for the next two weeks and compare the results head-to-head.

Don’t just look at sales volume. The key is to find the Maximum Profit Price Point. A lower price might generate more sales but result in less overall profit. A slightly higher price could lead to fewer sales but a much healthier bottom line.

Analyzing Historical Data for Future Success

Your past sales data is a goldmine of predictive information. Digging into this history helps you uncover seasonal trends, anticipate demand spikes, and understand just how sensitive your customers are to price changes.

Amazon's own use of historical price data has transformed how sellers approach pricing. Tools that reveal trends from past sales ranks have become essential. By studying these price fluctuations, sellers can identify safe margin ranges and avoid catastrophic price drops.

For instance, price history graphs are now a key feature on many listings, as 73% of buyers reportedly check them before making a purchase. This has pushed sellers toward more transparent and stable pricing. This data-first approach is how you build resilient and profitable Amazon pricing strategies for the long term.

Common Questions About Amazon Pricing (Answered)

Even with a solid strategy in place, you’re going to run into specific pricing questions. This section cuts through the noise and gives you direct answers to the most common things sellers ask, clearing up a few myths along the way.

Think of this as the quick-reference cheat sheet for your main pricing playbook.

How Often Should I Change My Prices on Amazon?

This completely depends on your product and your competition. For hot items in a crowded space, you might need to adjust prices multiple times a day to stay competitive. In fact, Amazon's own prices can change as often as every 10 minutes, which makes trying to keep up manually a losing battle. An automated repricing tool is really the only way to play the game on those listings.

But if you’re selling private label products where you’re the only one on the ASIN, you can breathe a little easier. For these, a weekly or bi-weekly price check is usually plenty. You’ll want to base those adjustments on your sales velocity, what you're learning from A/B tests, and any upcoming promotions you have planned.

Will Using a Repricer Start a Price War?

A repricer only starts a race to the bottom if you tell it to. A classic mistake is setting up a single, simple rule like "beat the lowest price." That’s a guaranteed way to tank your margins and everyone else's. Smart repricing isn't about being the cheapest; it's about being the smartest.

The key is setting firm guardrails. You need a floor price—your absolute rock-bottom profitable price—and a ceiling price to make sure you're not leaving money on the table. This guarantees the tool never sells at a loss.

Good repricing strategies are far more nuanced. You can set rules like:

- Match the current Buy Box holder's price, but don't go below them.

- Price slightly above the lowest FBM seller if you're FBA (leveraging your Prime badge).

- Automatically raise your prices the second a key competitor runs out of stock.

Remember, a repricer is just a tool. It's the strategy you build around it that determines whether it makes you money or costs you money.

What Is the Best Pricing Strategy for a New Product Launch?

When launching a new product, you almost always want to start with a penetration pricing strategy. This just means you set your initial price lower than your long-term goal. The idea is to get that first wave of buyers in the door and generate some much-needed sales velocity. Those early sales are a massive signal to Amazon's A9 algorithm.

Once you start getting traction, building up your rank, and collecting some positive reviews, you can slowly start inching the price up toward your target margin. To really pour gas on the fire, pair this lower launch price with other tactics like an introductory coupon or a tightly focused PPC campaign. It’s all about building momentum that will carry your product long after the launch phase is over.

At Next Point Digital, we turn complex marketplace challenges into clear growth opportunities. Our team combines data, technology, and deep ecommerce expertise to build and execute Amazon pricing strategies that win the Buy Box and protect your profits. Ready to move beyond guesswork? Schedule a consultation with Next Point Digital today.