Let's be real—acquiring new customers feels more expensive than ever. The secret to lowering your customer acquisition cost isn't just about cutting your ad budget. It's about spending smarter. That means shifting your focus from chasing every possible click to building a resilient growth engine that blends sharp acquisition tactics with powerful customer retention.

Why Your Customer Acquisition Cost Is Soaring

If it feels like your ad budget just doesn't stretch as far as it used to, you're not imagining things. For anyone selling on DTC channels or marketplaces like Amazon and eBay, navigating crowded platforms and rising ad prices is a daily battle. The old-school acquisition funnels are losing their punch, and a high Customer Acquisition Cost (CAC) can quietly sink an otherwise healthy business.

This guide cuts through the generic advice and gives you a clear, actionable playbook for today's market. We'll dig into how to build a system that not only attracts the right customers efficiently but also keeps them coming back for more. This is where truly effective, data-driven marketing strategies become your key to sustainable growth.

The Rising Tide of Acquisition Expenses

The numbers don't lie. The average loss from acquiring a new customer has exploded from just $9 in 2013 to a projected $29 by 2025—that's a staggering 222% jump. For e-commerce brands, the average CAC often lands somewhere between $68 and $78. The problem is, many businesses are still in the red on that first sale, gambling on repeat purchases that never materialize.

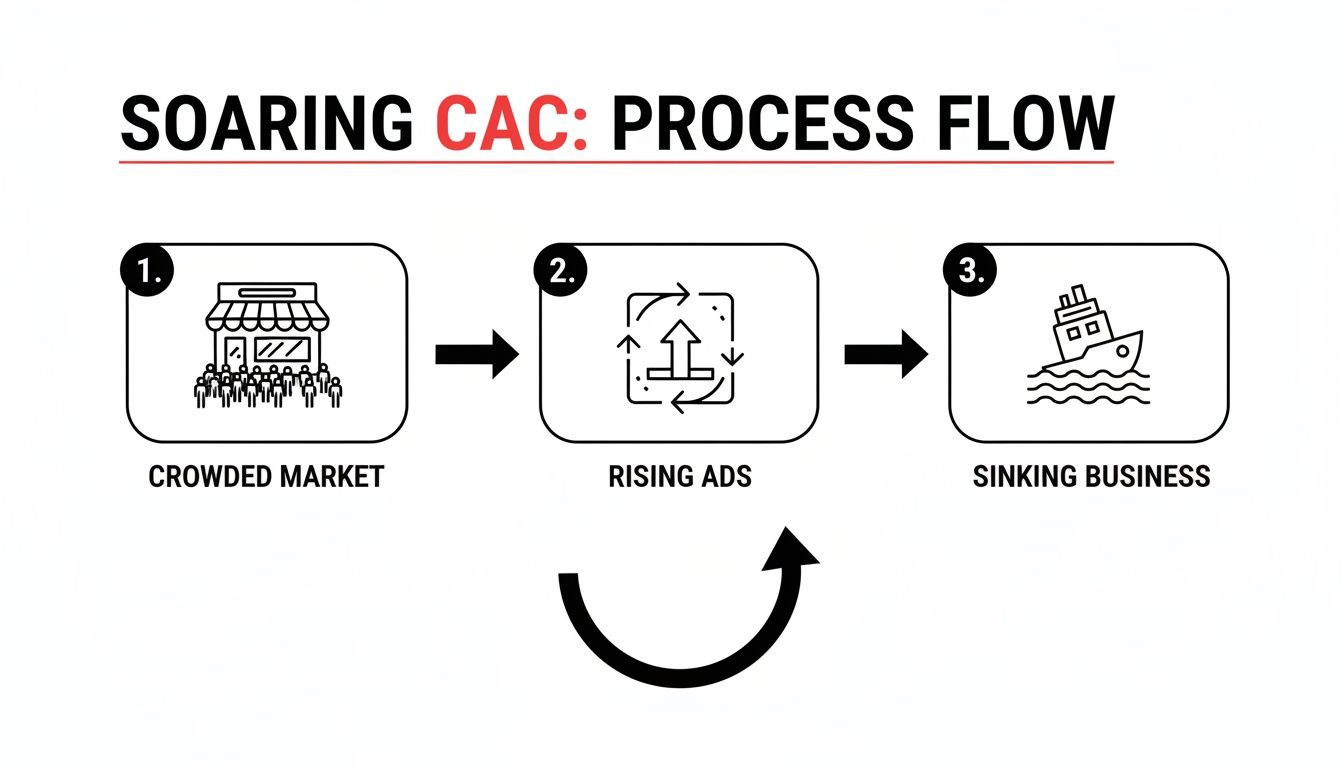

This simple flow shows just how quickly things can go south. A crowded market plus rising ad costs is a recipe for disaster if your CAC is out of control.

What you're seeing is a critical chain reaction: as competition gets fiercer and ad platforms demand more of your budget, unmanaged acquisition costs become a direct threat to your profitability.

The most dangerous expense is the one you don't track. A high CAC isn't just a marketing problem; it's a business model problem. It signals a serious imbalance between what you spend to get a customer and what that customer is actually worth to you.

Auditing and Tracking Your True CAC

You can't fix what you don't measure. Before you can even think about lowering your customer acquisition cost, you need a crystal-clear picture of what you’re actually spending to land each new customer. That simple formula you’ve heard—"total ad spend divided by new customers"—is a decent starting point, but it often hides the expensive truth.

This basic calculation misses all the crucial details. It just lumps all your marketing efforts together, making it impossible to tell which channels are your true profit centers and which are just draining your budget. To get a real handle on your spending, you have to dig deeper and audit your true CAC, channel by channel.

Moving Beyond a Blended CAC

A "blended" CAC that averages out all your marketing expenses gives you a foggy overview at best. It won't tell you if your Google Ads are crushing your Meta campaigns, or if your Amazon PPC is bringing in more profitable customers than your efforts on Walmart.

The first step is to draw a hard line between acquisition costs and retention marketing. For instance, the money spent on an email campaign to your existing customer base is not an acquisition expense. If you misattribute those costs, you’ll artificially inflate your CAC and end up making some really poor decisions.

Key Takeaway: A high-level, blended CAC is a vanity metric. Real optimization only starts when you can confidently say what it costs to get a customer from each specific channel, whether that's Google, Meta, Amazon, or TikTok.

This process means meticulously tagging every single marketing expense. And you have to think beyond just the ad spend itself. Be sure to include related costs like:

- Creative Production: The cost to design graphics or produce video ads.

- Tool Subscriptions: What you pay for analytics, keyword research, or automation software.

- Agency or Freelancer Fees: Any outside help you’re paying to run campaigns.

- Specific Salaries: A portion of your marketing team's salary directly tied to acquisition activities.

Getting a grip on these fully-loaded costs is non-negotiable. As you conduct this audit, it's also the perfect time to evaluate how effectively you're using your marketing stack, which includes mastering marketing automation ROI for more sustainable growth.

Setting Up Your Channel-Specific Tracking

Once you’ve got your costs properly sorted, the next move is to connect them to results. This means having rock-solid conversion tracking in place for every single platform. You absolutely must be able to trace a new customer back to the specific ad and channel that brought them to you.

This is where attribution models come into play. A first-touch attribution model might give all the credit to the very first ad a customer ever saw, while a last-touch model credits the final ad they clicked before buying. For most ecommerce brands, a last-touch or data-driven model usually provides the clearest picture, but the right choice really depends on your sales cycle.

Let's say you're selling on Amazon. Your tracking needs to be super precise. You have to know which campaigns are actually driving sales for specific ASINs. Digging into your Amazon sales data helps you see which products are acquiring customers most efficiently, letting you double down on what’s actually working.

To put this all into practice, you’ll want to create a simple spreadsheet or a dashboard to keep an eye on the key metrics for each channel. Here's a breakdown of the essential metrics you should be monitoring to accurately track and diagnose your CAC across your main advertising channels.

Essential CAC Tracking Metrics by Channel

| Metric | Google/Meta Ads | Amazon/Walmart PPC | DTC (Direct-to-Consumer) |

|---|---|---|---|

| Total Spend | Campaign-level ad spend plus creative/management costs. | ACoS (Advertising Cost of Sale) and total campaign spend. | Fully-loaded ad spend, including tools and agency fees. |

| New Customers | Number of first-time buyers acquired from each campaign. | Attributed first-time orders from specific campaigns. | Tracked first-time purchases via UTMs or platform analytics. |

| Channel CAC | (Total Spend) / (New Customers) from that channel. | (Total PPC Spend) / (New Customers from PPC). | (Total Channel Spend) / (New Customers from Channel). |

By tracking CAC at this level, you transform a vague business metric into an actionable diagnostic tool. Suddenly, you can see with total clarity that your Google Shopping campaign might have a CAC of $45, while your Facebook prospecting campaign is sitting at a painful $70. This is the kind of insight that serves as the foundation for every optimization strategy that follows, giving you the power to cut wasteful spending and funnel your budget to the channels delivering truly profitable growth.

Optimizing Your Ad Spend for Better Returns

Once you've nailed down your true, channel-specific CAC, it's time to make every ad dollar work harder. The single biggest lever you can pull to lower acquisition costs is shifting your mindset from 'spending more' to 'spending smarter.' This means digging past the surface-level metrics and getting into the guts of your paid media campaigns to cut the fat and double down on what’s actually working.

Refining ad spend isn't about making sweeping budget cuts. Think of it more like surgical precision—you're identifying high-intent customers and reaching them the moment they're ready to buy, without overpaying for the privilege.

Precision Targeting and Audience Segmentation

Broad, generic targeting is the fastest way I’ve seen brands burn through their ad budget with nothing to show for it. Stop casting a wide net. Instead, get obsessive about creating hyper-specific audience segments. The goal is to perfectly match your ad creative and offer to the unique needs and intent of each group.

Take a platform like Meta, for instance. Don't just target a vague interest like "running." Go deeper and segment it.

- Broad Interest: People who like the general topic of "running."

- Engaged Segment: People who have recently engaged with running-related content or pages.

- High-Intent Segment: People who hit your "running shoes" product page in the last 14 days but didn't buy.

Each of these segments needs a completely different message. The broad group might get a blog post or a video, while the high-intent group gets a direct offer with a clear call-to-action. This layered approach concentrates your spend on users who are far more likely to convert, which directly slashes your CAC.

Expert Tip: When you build lookalike audiences, base them on your best customers—not just all your website visitors. An audience modeled after customers with a high LTV is exponentially more valuable and will convert at a lower cost than one built from one-time buyers.

Eliminating Wasted Spend with Negative Keywords

For any paid search campaign on Google, Amazon, or Walmart, your negative keyword list is just as crucial as your target keyword list. Negative keywords are your defense, stopping your ads from showing up for irrelevant searches that get you clicks you have to pay for but that will never, ever convert.

Imagine you sell premium leather laptop bags. Without a solid negative keyword list, your ad for "leather laptop bag" could easily show up for searches like:

- "cheap laptop bag"

- "laptop bag repair"

- "how to clean a leather bag"

- "free laptop bag"

Every single click from those queries is money down the drain. Make it a non-negotiable weekly task to mine your search term reports, find these irrelevant terms, and add them to your negative list. It's one of the most immediate ways to reduce customer acquisition cost. For a deeper look at how this fits into a bigger picture, exploring the best ecommerce marketing strategies can connect the dots.

Smarter Bidding and Marketplace PPC Structures

On marketplaces like Amazon and Walmart, it’s so easy to get fixated on ACoS (Advertising Cost of Sale). But a low ACoS doesn't automatically mean a campaign is healthy. A far more revealing metric is TACOS (Total Advertising Cost of Sale), which measures your ad spend against your total revenue, not just ad-driven sales. This tells you if your ads are actually lifting your organic sales and ranking—which is the whole point.

For marketplace sellers, how you structure your PPC is everything:

- Auto Campaigns: Use these for keyword discovery. Let the platform do the heavy lifting and find new, relevant search terms for you.

- Manual Campaigns: Once you find high-performing keywords in your auto campaigns, move them into exact-match manual campaigns where you get total control over the bids.

- Brand Defense: You have to run campaigns on your own brand name. If you don't, your competitors will, stealing customers right from under your nose.

On the DTC side, it's worth looking into AI-powered bidding tools. These systems analyze thousands of data points in real-time to adjust bids, making sure you pay the optimal price for every click. This User Acquisition Manager's Guide to AI for Ads gives some great, practical insights into how automation can dramatically lower CAC by optimizing creative and bids at the same time. By letting the tech handle the manual work, you can finally focus on strategy instead of being stuck in the weeds.

Boosting Your Conversion Rate to Lower CAC

What if you could slice your customer acquisition cost in half without spending a single extra dollar on ads? That’s the power of Conversion Rate Optimization (CRO).

Every dollar you pour into paid media is an investment to get a potential customer to your product page or website. If that page doesn't convince them to buy, you’ve not only lost a sale—you’ve wasted your ad spend.

Boosting your conversion rate is the most direct route to lowering your CAC. A higher conversion rate means more customers from the exact same amount of traffic, which immediately makes every ad dollar you spend more efficient. It’s all about bridging the gap between your ad performance and the experience a customer has once they land on your digital doorstep.

Optimizing Your DTC Website Experience

For direct-to-consumer brands, your website is your sales engine. Every single element, from the homepage banner to the final "thank you" page, can either help or hinder a conversion. The goal is simple: remove every possible point of friction and build a seamless, trustworthy path to purchase.

Start with the basics. Website speed is no longer a "nice-to-have." Studies show that even a one-second delay in page load time can cause a significant drop in conversions. Customers expect a fast, responsive experience, especially on their phones.

Next, attack your checkout process. A long, complicated checkout is one of the top reasons for cart abandonment, hands down.

- Slash the number of form fields. Only ask for the absolute essentials.

- Offer guest checkout. Forcing users to create an account is a notorious conversion killer.

- Provide multiple payment options. Including digital wallets like Apple Pay, Google Pay, and PayPal can drastically speed things up.

Finally, remember that your product visuals are your most powerful sales tool. High-quality, professional images and videos showing your product from multiple angles and in real-world use are non-negotiable. They build trust and help customers imagine the product in their own lives.

Winning on Amazon and Walmart

For marketplace sellers, your product detail page is your landing page. You have a limited set of tools to work with, so making every one count is critical for turning browsers into buyers. Your title, bullets, and images are the first things a customer sees—and judges.

Your product listing isn’t just a description; it’s a sales pitch. Every word should be focused on highlighting benefits, answering potential questions, and overcoming objections before they even arise.

Your product title needs to be both keyword-rich for search visibility and compelling enough to earn a click. Follow that with benefit-driven bullet points. Don’t just list features; explain how those features solve a problem or improve the customer’s life.

For example, instead of saying "10,000 mAh battery," try "All-Day Power: With a massive 10,000 mAh battery, you can stream, work, and connect for over 24 hours without searching for an outlet." See the difference?

And don’t forget to take full advantage of A+ Content (or Enhanced Brand Content). This is your chance to tell your brand story, showcase your product with lifestyle imagery, and provide detailed comparison charts. A well-designed A+ section can significantly lift conversion rates by building credibility and answering those deeper customer questions.

Making A/B Testing a Core Discipline

You should never assume you know what will convert best. The only way to know for sure is to test.

A/B testing, also known as split testing, is the practice of comparing two versions of a webpage, product listing, or ad to see which one performs better. This disciplined approach removes guesswork from the equation and lets cold, hard data guide your decisions. You can test nearly anything to find what truly resonates with your audience.

Common Elements to A/B Test:

- Headlines and Product Titles: Test different angles—benefit-focused vs. feature-focused.

- Calls-to-Action (CTAs): Compare button text ("Buy Now" vs. "Add to Cart"), colors, and placement.

- Product Images: Test lifestyle photos against clean, white-background product shots.

- Pricing and Offers: See how a small discount stacks up against a "free shipping" offer.

By continuously running these tests, you can make small, incremental improvements that add up to a major impact on your conversion rate. Over time, that translates to a significant reduction in your customer acquisition cost. To get started, you can find a number of actionable conversion rate optimization tips that apply to both DTC sites and marketplace listings.

Using Customer Lifetime Value to Reduce CAC

So far, we’ve been digging into how to make your initial customer acquisition more efficient. But the most sustainable way to lower your CAC isn't just about finding new customers—it's about getting more from the ones you already have.

It's a simple but powerful shift in thinking: from pure acquisition to smart retention.

This is where the relationship between Customer Lifetime Value (LTV) and CAC becomes the most critical metric for your business’s health. LTV is the total revenue you can expect to bring in from a single customer over their entire relationship with your brand.

When you boost your LTV, you’re essentially spreading that initial acquisition cost over several purchases. A $50 CAC might feel steep for a $60 first-time order. But if that customer comes back three more times? Suddenly, that $50 investment looks a lot healthier.

The Gold Standard LTV to CAC Ratio

For any e-commerce business to be profitable and scalable, its LTV has to be significantly higher than its CAC. The accepted gold standard in the industry is a 3:1 LTV-to-CAC ratio. For every dollar you spend bringing a customer in the door, you should be making at least three dollars back from them over time.

- A 1:1 ratio means you're actually losing money on every new customer once you factor in the cost of your products.

- Anything below 3:1 suggests your profitability is on shaky ground, leaving little cash to reinvest in growth.

- A ratio of 4:1 or higher? That’s the sign of a strong, efficient business with fantastic customer loyalty.

Key Insight: Obsessing over your LTV-to-CAC ratio forces you to stop chasing short-term ad wins and start building a long-term, profitable business. It makes you think about the entire customer journey, not just the first sale.

Getting to that healthy ratio isn’t luck; it requires a deliberate strategy to turn one-time buyers into loyal fans who keep coming back.

Strategies to Increase Repeat Purchases

The moment a customer completes their first purchase is your best opportunity to start building a relationship. This is where you lay the groundwork for their next order by adding value and staying top-of-mind without being annoying.

This shift can have a massive impact on your bottom line. It’s 5 to 25 times cheaper to keep an existing customer than to acquire a new one. In fact, just a 5% bump in customer retention can increase profits by 25-95%.

Here are some proven ways to get more value from the customers you’ve already won.

1. Build Effective Email and SMS Flows

Don't let your communication end with the transactional receipt. That’s a huge missed opportunity. Instead, set up automated email and SMS flows to engage customers at just the right moments.

- Welcome Series: Go beyond the "thanks for your order" email. Share your brand story and showcase other products they might love.

- Post-Purchase Follow-up: Send tips on how to get the most out of the product they just bought. Make them feel like an insider.

- Replenishment Reminders: If you sell consumables, send a friendly reminder right when they might be running low.

2. Launch a Simple Loyalty Program

A loyalty program doesn't need to be complicated to be effective. The goal is simple: reward people for coming back and make them feel appreciated.

Start with a basic points system. Customers earn points for every dollar they spend, which they can redeem for discounts on future orders. This creates a natural incentive loop that encourages them to shop again and again.

3. Offer Subscriptions for Recurring Revenue

For products people buy regularly—like coffee, supplements, or skincare—subscriptions are a total game-changer. A "subscribe and save" model gives your customers convenience and a small discount while giving your business predictable, recurring revenue.

This is the ultimate way to maximize LTV. You lock in future sales from a single acquisition effort, making your initial CAC incredibly efficient. Of course, this relies on smart pricing, so it helps to understand how to determine the price of a product to make your subscription offer irresistible.

Frequently Asked Questions About Reducing CAC

Even with a solid game plan, questions always come up once you start digging into the details of lowering your customer acquisition cost. We get it. We've compiled the most common questions we hear from ecommerce brands to give you the clarity you need to actually put these strategies to work.

Remember, tackling CAC isn't a "set it and forget it" task—it’s an ongoing process. Having these foundational answers handy will help you stay on course as you fine-tune your approach and build a more profitable brand.

What Should Be Included in My CAC Calculation?

This is the big one, because if you get this wrong, all of your data will be skewed from the start. A true, fully-loaded CAC goes way beyond just what you spend on Google or Amazon ads.

To get an honest number, you have to tally up every single cost that goes into acquiring a new customer during a specific time frame. That means you should be tracking:

- Total Ad Spend: The obvious one—what you pay the ad platforms directly.

- Salaries: A portion of the salaries for any marketing and sales team members involved in customer acquisition.

- Creative Costs: Any money spent on designing ad creative, product photography, or video production.

- Software and Tools: Subscription fees for your keyword research, analytics, or ad management tools.

- Agency or Freelancer Fees: Payments to any outside partners helping run your campaigns.

A critical mistake to avoid: don’t mix acquisition costs with retention costs. The money you spend on an email campaign targeting your existing customers, for example, is a retention expense and should never be included in your CAC calculation.

How Can I Start Reducing CAC on a Small Budget?

You don't need a massive budget to make a dent in your CAC. In fact, some of the most powerful moves are about being smarter with the resources you already have, not just spending more money.

If you’re working with limited funds, get laser-focused on high-impact, low-cost optimizations. Start by doing a ruthless audit of your paid search campaigns and building out your negative keyword lists. This costs nothing but your time and immediately stops you from wasting money on clicks that will never, ever convert.

Next, turn your attention to Conversion Rate Optimization (CRO). Simple A/B tests on things like your product page headlines, call-to-action buttons, or main image can deliver a serious lift in conversions without costing you a dime more in ad spend. Improving the on-page experience is one of the highest-leverage activities you can do, regardless of your budget.

What Is a Good LTV to CAC Ratio?

CAC is a crucial metric, but it tells you so much more when you put it next to your Customer Lifetime Value (LTV). That ratio is what tells you if your acquisition engine is actually profitable and sustainable for the long haul.

The gold standard for a healthy ecommerce business is a 3:1 LTV-to-CAC ratio.

What that means is for every $1 you spend to get a new customer, you should be generating at least $3 in revenue from that same customer over their entire relationship with your brand.

- A 1:1 ratio is a red flag. You're essentially losing money on every new customer once you factor in the cost of your products.

- Anything below 3:1 suggests your business might struggle with profitability and won't have much cash left to reinvest in growth.

- A ratio of 4:1 or higher is a fantastic sign. It points to an efficient business model with excellent customer loyalty.

Focusing on this ratio forces you to think beyond the first sale and build a business based on long-term value.

How Long Does It Take to See Results?

The timeline really depends on which levers you're pulling. Some actions can produce results almost overnight, while others are more of a long game.

You can see changes from tactical tweaks within a matter of days. For instance, adjusting your ad campaign's location targeting or adding a fresh batch of negative keywords can lower your cost-per-click and CAC in as little as 24-48 hours.

On the other hand, bigger strategic initiatives require patience. Improving your website's conversion rate with A/B testing or boosting LTV with a new loyalty program are efforts that could take one to three months to show a significant, measurable impact on your overall CAC. The best approach is always a mix of both short-term wins and long-term strategies.

At Next Point Digital, we build data-driven strategies that turn clicks into profitable sales. Our team combines marketplace expertise with AI-powered advertising to lower your customer acquisition costs and scale your brand across every channel. Schedule a consultation with us today.